Traditional Energy Providers Leaving Value on the Table by Not Fully Serving Small and Medium-Sized Businesses, Research from Accenture Shows

Traditional energy providers are missing out on substantial cost savings and new revenues by not tailoring enough digital customer experiences, products and services for small and medium-sized businesses (SMBs), according to the latest edition of the “New Energy Consumer” research from Accenture (NYSE: ACN).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190124005044/en/

(Photo: Business Wire)

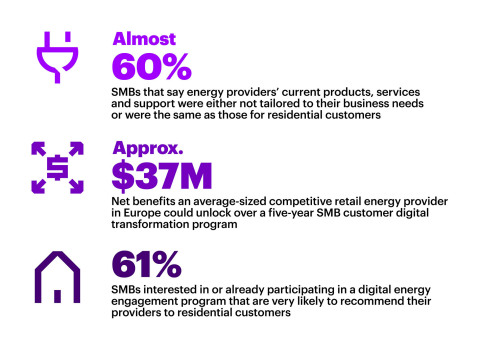

The research, based on a survey of nearly 3,800 SMBs across North America, South America, Europe and Asia Pacific, found that almost 60 percent of SMBs said that energy providers’ current products, services and support were either not tailored to their business needs or were the same as those for residential customers, who often have different needs.

“Our analysis shows that in competitive European markets, for example, an average-sized retail energy provider could unlock up to approximately US$37 million in net benefits over a five-year SMB customer digital transformation program with tailored services,” said Tony Masella, a senior managing director at Accenture who leads its Energy Retail and Customer Services practice. “The SMB segment tends to be forgotten, yet it offers significant value for providers using digital channels in the new energy ecosystem.”

The survey reveals that SMBs are more likely to try new products and services as business customers than they are as residential customers. What’s more, there’s a ripple effect with residential customer behavior, as the majority (61 percent) of SMBs interested or already participating in a digital energy engagement program are very likely to recommend their providers to residential customers.

Embedding innovative technologies, such as artificial intelligence, into digital customer experience value propositions can help, and SMBs are willing and ready to try them. Accenture’s study found, for example, that 67 percent of SMBs believe that digital agents could give them tailored business advice as they draw from more information sources.

The survey also found that SMBs are interested in mutually beneficial partnership opportunities with their energy providers. For instance, 43 percent of SMBs said they’re interested in solar-power sharing programs in which they could partner with their energy providers to co-own and co-operate solar panels on their business premises in exchange for a bill discount.

Nearly the same number (42 percent) cited an interest in teaming with their energy provider to offer new energy-related products and services through their business to generate new revenues, such as a grocery store selling energy-efficient thermostats to its customers.

The findings also indicate that traditional energy providers face potential competition from specialized energy services companies when it comes to winning over customers. While 80 percent of SMBs consider traditional energy providers for purchasing energy-related products and services, a majority of consumers (59 percent) said they would also consider their phone, internet or cable provider or consumer electronics company.

“This competition highlights the urgency for traditional energy providers to act now and take advantage of digital energy engagement, which our survey found drives a more than sevenfold increase in SMBs’ likelihood to sign up for additional energy-related products and services,” Masella said. “To land new customers, energy providers need to offer programs with tailored business insights from customers’ data, deliver an interactive connected energy experience, and make these services an effortless experience.”

Competition is more urgent in deregulated markets, where larger SMBs have a higher potential than residential customers for switching energy providers to get better deals and efficiencies. In fact, almost half (46 percent) of SMBs in deregulated markets said they are certainly or probably planning to switch providers in the next 12 months.

That figure — driven significantly by larger SMBs, which have greater energy costs — is 50 percent higher than the number of residential energy consumers who said they plan to switch (29 percent). The factors that would motivate SMBs to switch include receiving a specific energy engagement program (cited by 44 percent) and enhanced customer service and support (44 percent) tailored to their business needs.

Research methodology

As part of its continuing New Energy Consumer research program, Accenture surveyed 3,753 small to medium-size businesses across 14 countries and one geography (Hong Kong) representing both competitive and non-competitive energy markets: Argentina, Australia, Brazil, Canada, France, Germany, Italy, Japan, Malaysia, Netherlands, Spain, Sweden, the United Kingdom and the United States. The survey was conducted online in March 2018.

About Accenture

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialized skills across more than 40 industries and all business functions — underpinned by the world’s largest delivery network — Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders. With 469,000 people serving clients in more than 120 countries, Accenture drives innovation to improve the way the world works and lives. Visit us at www.accenture.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190124005044/en/