Mexichem Announces First Quarter 2019 Results

Mexichem, S.A.B. de C.V. (BMV: MEXCHEM*) (“the Company” or “Mexichem”) today announced unaudited results for the first quarter of 2019.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190424006157/en/

(Graphic: Business Wire)

“As we expected, the current PVC, caustic soda and ethane/ethylene market environments resulted in overall lower reported revenue growth and lower earnings this quarter, and while we expect this environment to continue to present a challenge to overall results throughout the year, we are pleased by the momentum in our Datacom, Precision Agriculture and Building and Infrastructure businesses within the Fluent Group," commented Mexichem CEO Daniel Martínez-Valle.

"We have tremendous confidence in the potential of long-term value from Mexichem's transformation into a purpose-driven, future fit organization. Since we embarked on this journey last year, Mexichem has become a more focused organization that effectively addresses our customers’ needs by creating global synergies, stronger global innovations and faster local innovation, and best-for-the-world solutions to help solve global challenges," he added.

FIRST QUARTER 2019 FINANCIAL RESULTS

| mm US$ | First Quarter | ||||||||

| Financial Highlights | 2019 | 2018 | %Var. | ||||||

| Net sales | 1,766 | 1,756 | 1% | ||||||

| Operating income | 186 | 227 | -18% | ||||||

| EBITDA | 318 | 330 | -4% | ||||||

| EBITDA margin | 18.0% | 18.8% | -77 bps | ||||||

| EBITDA wo IFRS 16 effect | 300 | 330 | -9% | ||||||

| EBT | 116 | 162 | -28% | ||||||

| Income (loss) from continuing operations | 77 | 111 | -31% | ||||||

| Consolidated net income (loss) | 77 | 111 | -31% | ||||||

| Net majority income | 48 | 79 | -39% | ||||||

| Operating cash flow before capex, buy-back shares program & dividends | (42) | (28) | 50% | ||||||

| Total CAPEX (organic & JV) | (60) | (66) | -9% | ||||||

| Operating cash flow before buy-back shares program & dividends | (102) | (94) | 9% | ||||||

| Free cash flow | (179) | (184) | -3% | ||||||

As of January 1, 2019, the Company adopted the new lease accounting standard (IFRS 16). Results for 2019 are presented under IFRS 16, while prior period amounts continue to be reported in accordance with our historic accounting, as required under the standard. Pro Forma 2019 EBITDA excluding the impact of the new lease standard is presented for comparative purposes.

The current quarter includes an $18.6 million favorable impact on EBITDA from the IFRS 16 adoption. The most significant benefits were $9 million in the Fluent Business Group and $7 million in the Vinyl Business Group.

Unless noted otherwise, all figures in this release are derived from the Interim Consolidated Financial Statements of the Company as of the three-month period ended March 31, 2019 and are prepared in accordance with International Accounting Standard 34 “Interim Financial Reporting” of the International Financial Reporting Standards (IFRS), which have been published in the Bolsa Mexicana de Valores (BMV). See Notes and Definitions at the end of this release for further explanation of terms used herein.

OPERATING RESULTS BY BUSINESS GROUP

VINYL Business Group: 32% and 30% of Mexichem’s Q1 2019 sales (after eliminations) and EBITDA, respectively.

| mm US$ | First Quarter | ||||||||

| Vinyl | 2019 | 2018 | %Var. | ||||||

| Total sales* | 595 | 646 | -8% | ||||||

| Operating income | 37 | 90 | -59% | ||||||

| EBITDA | 94 | 138 | -32% | ||||||

| EBITDA wo IFRS | 87 | 138 | -37% | ||||||

| *Intercompany sales were $35 million and $40 million in 1Q19 and 1Q18, respectively. | |||||||||

Vinyl total sales of $595 million were 8% below the first quarter of 2018, mainly due to lower volumes, tighter conditions in PVC and caustic soda prices due, in the latter, to an excess of supply in North America; and longer than expected programed and non-programmed overhauls in Mexico and Germany.

Reported EBITDA for the Vinyl Business Group of $94 million was 32% below Q1 2018. The decline resulted from the tougher PVC, caustic soda and ethane/ethylene market conditions, compared with those during the first nine months of 2018, which are continuing to pressure the ethane-to-PVC value chain; higher electricity prices in Mexico; and the impact of the overhauls mentioned above. EBITDA margin contracted to 15.9% in Q1 2019 from the 21.4% reported in Q1 2018. Without the effect of IFRS 16, EBITDA decreased 37% to $87 million, reflecting an implicit EBITDA margin of 14.6%.

Q1 2019 saw some sequential improvement in ethane prices but they continue to be higher than in Q1 2018, and together with ethylene, are expected to continue to be volatile during the year. Caustic soda market price conditions continued to be effected by a global excess of supply. PVC prices were also lower than the prior year. Although these market conditions are expected to remain challenging and volatile, we expect mid and long-term Vinyl EBITDA margins to be at levels similar to those of 2018 and 2017.

FLUENT Business Group: 57% and 40% of Mexichem’s Q1 2019 sales (after eliminations) and EBITDA, respectively.

| mm US$ | First Quarter | ||||||||

| Fluent | 2019 | 2018 | %Var. | ||||||

| Sales | 1,002 | 947 | 6% | ||||||

| Fluent LatAm | 253 | 269 | -6% | ||||||

| Fluent Europe | 329 | 350 | -6% | ||||||

| Fluent USA & Canada | 121 | 113 | 7% | ||||||

| Fluent AMEA | 41 | 39 | 5% | ||||||

| Netafim | 273 | 177 | 54% | ||||||

| Intercompany eliminations | (15) | (1) | 1400% | ||||||

| Operating income | 67 | 58 | 16% | ||||||

| EBITDA | 127 | 98 | 30% | ||||||

| EBITDA wo IFRS | 118 | 98 | 20% | ||||||

Fluent revenues of $1.0 billion in Q1 2019 were 6% above the same quarter last year due mainly to double digit growth in Netafim, related in part, to its consolidation as of February 7, 2018, and a 7% and 5% increase in Fluent U.S. and Canada and Fluent AMEA (mainly our Dura-Line Datacom business), respectively. These gains were only partly offset by a 6% decline in sales in both Fluent Europe and Fluent Latin America (mainly our Building and Infrastructure business comprising of Amanco and Wavin). On a constant currency basis, the Fluent Business Group’s revenues were $1.1 billion, 13% above the same period last year.

| 1Q18 | mm US$ |

1Q19 |

1Q19 | 1Q19/1Q18 | |||||||||||

| Sales | Sales | FX | Total | % Var | |||||||||||

| 269 | Fluent LatAm | 253 | 18 | 271 | 1% | ||||||||||

| 350 | Fluent Europe | 329 | 33 | 362 | 3% | ||||||||||

| 113 | Fluent US/Canada | 121 | - | 121 | 7% | ||||||||||

| 39 | Fluent AMEA | 41 | 3 | 44 | 13% | ||||||||||

| 177 | Netafim | 273 | 13 | 286 | 62% | ||||||||||

| (1) | Intercompany Eliminations | (15) | - | (15) | 1400% | ||||||||||

| 947 | Total | 1,002 | 67 | 1,069 | 13% | ||||||||||

| mm US$ | First Quarter | ||||||||

| Fluent | 2019 | 2018 | %Var. | ||||||

| Sales | 1,002 | 947 | 6% | ||||||

| B&I | 580 | 614 | -6% | ||||||

| Datacom | 165 | 159 | 4% | ||||||

| Precision Agriculture | 273 | 177 | 54% | ||||||

| Intercompany eliminations | (16) | (4) | 300% | ||||||

| Operating income | 67 | 58 | 16% | ||||||

| EBITDA | 127 | 98 | 30% | ||||||

| EBITDA wo IFRS | 118 | 98 | 20% | ||||||

|

Approximately 3% of our Building and Infrastructure revenues are related to Datacom products that are produced and sold in the Building and Infrastructure legal entities and plants, while approximately 11% of our Datacom sales numbers are not related to Datacom products (mainly associated to the natural gas distribution piping business). |

| 1Q18 | mm US$ |

1Q19

|

1Q19 | 1Q19/1Q18 | |||||||||||

| Sales | Sales | FX | Total | % Var | |||||||||||

| 614 | B&I | 580 | 50 | 630 | 3% | ||||||||||

| 159 | Datacom | 165 | 4 | 169 | 6% | ||||||||||

| 177 | Precision Agriculture | 273 | 13 | 286 | 62% | ||||||||||

| (4) | Intercompany Eliminations | (16) |

- |

(16) | 300% | ||||||||||

| 947 | Total | 1,002 | 67 | 1,069 | 13% | ||||||||||

First quarter 2019 Fluent Business Group EBITDA increased 30% to $127 million from $98 million in Q1 2018. This positive performance includes the consolidation of the full Q1 2019 of Netafim, acquired and closed on February 7, 2018; and Fluent LatAm, which increased when compared with Q1 2018, as we recognized the one-off expense related to the CADE.

Reported EBITDA margin widened to 12.7% from 10.3% from the same period last year. Excluding the impact of IFRS 16, EBITDA increased 20%, with an implied EBITDA margin of 11.8%. On a constant currency and organic basis, EBITDA increased 10% to reach $129 million, reflecting an EBITDA margin of 12.0%.

In Q1 2019, and principally in Fluent's emerging markets business, lower PVC price conditions, as compared with 2018, start to be reflected in the underlying trends of this Business Group.

FLUOR Business Group: 12% and 26% of Mexichem’s Q1 2019 sales (after eliminations) and EBITDA, respectively.

| mm US$ | First Quarter | ||||||||

| Fluor | 2019 | 2018 | %Var. | ||||||

| Sales | 205 | 204 | 0% | ||||||

| Operating income | 70 | 68 | 3% | ||||||

| EBITDA | 84 | 80 | 5% | ||||||

| EBITDA wo IFRS | 83 | 80 | 4% | ||||||

First quarter 2019 Fluor Business Group sales were flat as pricing conditions were in line with expectations.

EBITDA in Q1 2019 increased 5% to $84 million, reflecting an EBITDA margin of 41.0% compared with 39.4% in Q1 2018. Excluding the effect of IFRS 16, Fluor EBITDA increased 4% to $83 million, with an implied EBITDA margin of 40.4%.

CONSOLIDATED FINANCIAL INFORMATION

REVENUES

For Q1 2019, revenues totaled $1.77 billion, up $10 million, or 1% from Q1 2018. In a constant currency basis, sales by Business Groups were as follows:

| 1Q18 | mm US$ | 1Q19 | 1Q19 | 1Q19/1Q18 | |||||||||||

| Sales | Sales | FX | Total | % Var | |||||||||||

| 646 | Vinyl | 595 | 17 | 612 | -5% | ||||||||||

| 947 | Fluent | 1,002 | 67 | 1,069 | 13% | ||||||||||

| 1,593 | Ethylene (Vinyl + Fluent) | 1,597 | 84 | 1,681 | 6% | ||||||||||

| 204 | Fluor | 205 | 4 | 209 | 2% | ||||||||||

| (41) | Eliminations / Holding | (36) | - | (36) | -12% | ||||||||||

| 1,756 | Total | 1,766 | 88 | 1,854 | 6% | ||||||||||

The countries that represented more than 5% of Mexichem’s consolidated Q1 2019 revenues were: the U.S. 17%; Mexico 9%; Germany 8%; the UK 6%; Brazil 6%; and India 5%.

EBITDA

Consolidated reported Q1 2019 EBITDA was $318 million, 4% below the $330 million reported in the same quarter last year. EBITDA margin for the quarter was 18.0%. Without the effect of IFRS 16, adopted as of January 1, 2019, EBITDA decreased 9% to $300 million, reflecting an implicit EBITDA margin of 17.0%.

In Q1 2019, the FX effect on consolidated EBITDA was negative $11 million. On a constant currency and organic basis, EBITDA would have decreased 10% to $314 million, reflecting an implicit EBITDA margin of 17.0%.

| 1Q18 | mm US$ | 1Q19 | 1Q19 | 1Q19/1Q18 | |||||||||

| EBITDA | EBITDA | FX | Total | % Var | |||||||||

| 138 | Vinyl | 94 | 2 | 96 | -30% | ||||||||

| 98 | Fluent | 127 | 7 | 134 | 37% | ||||||||

| 236 | Ethylene (Vinyl + Fluent) | 221 | 9 | 230 | -3% | ||||||||

| 80 | Fluor | 84 | 2 | 86 | 8% | ||||||||

| 14 | Eliminations / Holding | 13 | - | 13 | -7% | ||||||||

| 330 | Total | 318 | 11 | 329 | 0% | ||||||||

OPERATING INCOME

Mexichem reported operating income for Q1 2019 of $186 million, compared to $227 million reported in Q1 2018, an 18% decrease.

FINANCIAL COSTS

Q1 2019 financial costs increased $8 million to $72 million, 13% above Q1 2018. The increase was due mainly to higher net interest expenses and bank commissions due to a $6 million mark-to-market valuation of the financial instrument related to the Netafim acquisition; $5 million of bank commissions related to bank loans; $3 million less interest earned due to the lower average cash position in Q1 2019 versus Q1 2018; $2 million of higher interest expenses related to the $200 million bilateral loan taken by Mexichem at the end of January 2018 for the Netafim acquisition; $2 million of lease interest related primarily to IFRS 16; and a $2 million decrease in the monetary position in our Venezuelan and Argentinean operations. These impacts were offset by a decrease of $12 million in foreign exchange losses, mainly associated to the passive position in Mexican pesos of companies which have the U.S. dollar as their functional currency because of lower appreciation of the Mexican peso against the dollar in Q1 2019 compared to Q1 2018.

TAXES

While income from continuing operations before income taxes decreased 28% in Q1 2019 compared with Q1 2018, cash tax increased 4% or $2 million due mainly to a change in the mix of companies within Mexichem that win or lose during the period, the recognition of taxes generated by the differential income tax rates of the European and U.S. subsidiaries that paid intercompany dividends, and the recognition of tax profits derived from revaluations of currencies other than the functional currency of the corresponding companies within Mexichem. The deferred tax benefit increased to $16 million in Q1 2019 from $1 million in Q1 2018 due primarily to the recognition of deferred assets on the revaluation of currencies other than the U.S. dollar. The effective tax rate in Q1 2019 was 32.8% compared with 31.5% for the same period last year.

CONSOLIDATED NET INCOME (LOSS) AND MAJORITY INCOME (LOSS)

As a result of the above, the Company reported a 31% decline in consolidated net income to $77 million from $111 million in Q1 2018. Net majority income decreased 39% to $48 million from $79 million in Q1 2018.

| USD in millions | First Quarter | ||||||||

| Income statement | 2019 | 2018 | % | ||||||

| Income (loss) from continuing operations before income tax | 116 | 162 | -28% | ||||||

| Cash tax | 54 | 52 | 4% | ||||||

| Income (loss) from continuing operations after cash tax | 62 | 110 | -44% | ||||||

| Deferred taxes | (16) | -1 | 1500% | ||||||

| Income (loss) from continuing operations | 77 | 111 | -31% | ||||||

| Discontinued operations | - | 0 | |||||||

| Consolidated net income (loss) | 77 | 111 | -31% | ||||||

| Minority stockholders | 29 | 32 | -9% | ||||||

| Net income (loss) | 48 | 79 | -39% | ||||||

BALANCE SHEET AND OPERATING CASH FLOW HIGHLIGHTS

OPERATING CASH FLOW HIGHLIGHTS

| First Quarter | |||||||||

| mm US$ | 2019 | 2018 | %Var. | ||||||

| EBITDA | 318 | 330 | -4% | ||||||

| Taxes paid | (54) | (54) | 0% | ||||||

| Net interest paid | (84) | (74) | 14% | ||||||

| Bank commissions | (5) | (3) | 67% | ||||||

| Exchange rate gains (losses) | (1) | (10) | -90% | ||||||

| Change in trade working capital (1) (2) | (215) | (217) | -1% | ||||||

| Operating cash flow before capex, buy-back shares program & dividends | (42) | (28) | 50% | ||||||

| Total CAPEX (organic & JV) | (60) | (66) | -9% | ||||||

| Operating cash flow before buy-back shares program & dividends | (102) | (94) | 9% | ||||||

| Buy-back shares program | 3 | (15) | N/A | ||||||

| Operating cash flow before dividends | (99) | (110) | -10% | ||||||

| Shareholders' dividend | (79) | (74) | 7% | ||||||

| Free cash flow | (179) | (184) | -3% | ||||||

|

(1) PMV's insurance A/R is not included in trade working capital calculation. |

|||||||||

|

(2) Trade working capital variation (Mar 18 vs Dec 17) includes Netafim's proforma results for comparative purposes. |

|||||||||

First quarter 2019 operating cash flow before CapEx, share buybacks and dividends were negatively effected by: i) $12 million lower EBITDA; ii) higher financial cost paid due mainly to the renewal of Netafim credit facilities and the $200 million bilateral loan for the Netafim acquisition; and iii) lower interest earned of $3 million due to lower average cash balances in Q1 2019 vs Q1 2018. These effects were partly offset by lower FX losses and working capital. Capital expenditures decreased 9% to $60 million.

NET WORKING CAPITAL

| 2019 Variation | 2018 Variation | |||||||||||||||||

| mar-19 | dec-18 |

Δ ($) |

mar-18 | dec-17 |

Δ ($) |

|||||||||||||

| Trade Working Capital | 817 | 602 | (215) | 727 | 510 | (217) | ||||||||||||

From December 31, 2018 to March 31, 2019, the change in working capital improved to a need of $215 million from $217 million during the same period last year.

FINANCIAL DEBT

| Last Twelve Months | ||||||

| Mar 2019 | Dec 2018 | |||||

| Net Debt USD million | 2,994 | 2,871 | ||||

| Net Debt/EBITDA 12 M | 2.16x | 2.05x | ||||

| Interest coverage | 5.23x | 5.59x | ||||

|

Note: Net debt includes $0.3 million of letters of credit with maturities of more than 180 days that for covenant purposes are considered gross debt. |

||||||

As of March 31, 2019, net financial debt for covenant purposes was $3.0 billion, comprised of total financial debt of $3.6 billion less cash and cash equivalents of $589 million.

Net Debt/EBITDA was 2.16x (without IFRS 16 was 2.19x) as of March 31, 2019, while Interest Coverage was 5.23x.

RECENT EVENTS

- Vinyl: In April 2019, we were notified that The Superintendency of Industry and Commerce (Superintendencia de Industria y Comercio) in Colombia initiated an investigation against Mexichem Derivados Colombia SA, for alleged violations of the first article of Law 155 of 1959, for supposedly reaching an agreement with its competitors to exit the market of importing, distributing and selling caustic soda in Colombia. As this is an ongoing process, we cannot comment about this issue. Mexichem is in favor of healthy competition, and as a global company, we foster a culture of integrity and compliance with the all applicable laws and regulations where we do business, including Colombian laws. We reiterate our best disposition to collaborate with the authorities in order to clarify the situation.

Conference Call Details

Mexichem will host a conference call to discuss our Q1 2019 results on April 25th, 2019 at 10:00 am Mexico City/11:00 am (US Eastern Time). To access the call, please dial 001-855-817-7630 (Mexico), 1-888-339-0721 (United States) or 1-412-317-5247 (International). Participants may pre-register for the conference call here.

A recording of the webcast will be posted on our website within several hours after the call is completed. The webcast can be accessed via the following link: https://services.choruscall.com/links/mexichem190228.html.

The replay can be accessed via Mexichem’s website at https://www.mexichem.com/.

For all the news, please visit the following webpage https://www.mexichem.com/newsroom/.

CONSOLIDATED INCOME STATEMENT

| USD in millions | First Quarter | ||||||||

| Income Statement | 2019 | 2018 | % | ||||||

| Net sales | 1,766 | 1,756 | 1% | ||||||

| Cost of sales | 1,297 | 1,282 | 1% | ||||||

| Gross profit | 469 | 474 | -1% | ||||||

| Operating expenses | 282 | 247 | 14% | ||||||

| Operating income (loss) | 186 | 227 | -18% | ||||||

| Financial Costs | 72 | 64 | 13% | ||||||

| Equity in income of associated entity | (1) | (1) | 0% | ||||||

| Income (loss) from continuing operations before income tax | 116 | 162 | -28% | ||||||

| Cash tax | 54 | 52 | 4% | ||||||

| Deferred taxes | (16) | (1) | 1500% | ||||||

| Income tax | 38 | 51 | -25% | ||||||

| Income (loss) from continuing operations | 77 | 111 | -31% | ||||||

| Discontinued operations | - | - | |||||||

| Consolidated net income (loss) | 77 | 111 | -31% | ||||||

| Minority stockholders | 29 | 32 | -9% | ||||||

| Net income (loss) | 48 | 79 | -39% | ||||||

| EBITDA | 318 | 330 | -4% | ||||||

| EBITDA wo IFRS 16 effect | 300 | 330 | -9% | ||||||

CONSOLIDATED BALANCE SHEET

| USD in millions | ||||||

| Balance sheet | Mar 2019 | Dec 2018 | ||||

| Total assets | 10,356 | 10,062 | ||||

| Cash and temporary investments | 589 | 700 | ||||

| Receivables | 1,337 | 1,150 | ||||

| Inventories | 897 | 866 | ||||

| Others current assets | 243 | 262 | ||||

| Property, plant and equipment, Net | 3,458 | 3,507 | ||||

| Intangible assets and Goodwill | 3,313 | 3,345 | ||||

| Right of use Fixed Assets, Net | 293 | - | ||||

| Long term assets | 226 | 232 | ||||

| Total liabilities | 7,128 | 6,892 | ||||

| Current portion of long-term debt | 379 | 396 | ||||

| Suppliers | 1,417 | 1,414 | ||||

| Short-term leasings | 72 | 18 | ||||

| Other current liabilities | 876 | 881 | ||||

| Long-term debt | 3,204 | 3,175 | ||||

| Long-term employee benefits | 197 | 182 | ||||

| Long-Term deferred tax liabilities | 330 | 349 | ||||

| Long-term leasings | 220 | 15 | ||||

| Other long-term liabilities | 433 | 462 | ||||

|

Consolidated shareholders' equity |

3,228 | 3,170 | ||||

| Minority shareholders' equity | 752 | 761 | ||||

| Majority shareholders' equity | 2,476 | 2,409 | ||||

| Total liabilities & shareholders' equity | 10,356 | 10,062 | ||||

Notes and Definitions

The results contained in this release have been prepared in accordance with International Financial Reporting Standards (“NIIF” or “IFRS”) having U.S. dollars as the functional and reporting currency. Figures are presented in millions, unless specified otherwise.

Commencing Q1 2019, Business Groups EBITDA are reported inclusive of corporate charges; comparable prior year figures have been adjusted accordingly.

In our continuous effort to better inform the market, and as part of our transformational journey to become a more customer-centric organization, beginning Q1 2019, Fluent revenues will be presented geographically and by global business division: Building and Infrastructure (Wavin in Europe and Amanco in LatAm), Datacom (Fluent U.S. and Canada and Fluent AMEA – Dura-Line) and Precision Agriculture (Netafim).

Fluent Business Group’s prior year results include those of Netafim as of the February 7, 2018 acquisition closing date.

The terms “Organic Basis” or “Organically” mean figures excluding the effects of IFRS 16 in 2019, CADE and Netafim Ltd. acquisition-related expenses.

“FX translation effect” figures, which reflect results on a “constant currency” basis or “without FX translation effects,” do not include any positive or negative effect from Venezuela due to the uncertainties of the economic fundamentals of its FX market and due to its immaterial impact on consolidated results.

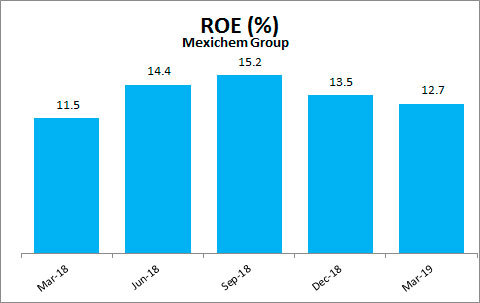

"ROE" means Income from continuing operations / Adjusted Average Equity from continuing operations.

"ROIC" means Adjusted NOPAT from continuing operations/Adjusted Equity from continuing operations plus Liabilities with cost – Cash. Income from continuing operations and NOPAT (EBIT – taxes) consider trailing 12 months.

Figures and percentages have been rounded and may not add up.

ABOUT MEXICHEM

Mexichem is a global leader supplier of innovative solutions across multiple industries including building and infrastructure, data communications, irrigation and chemicals, and more. With operations in 41 countries, 137 facilities worldwide and more than 22,000 employees, Mexichem has the rights to produce fluorspar in two mines in Mexico, as well as 8 training academies and 19 R&D labs. Operations are divided into three Business Groups: Fluent, Vinyl and Fluor. Mexichem has annual revenues of U.S. $7.2 billion and has been traded on the Mexican Stock Exchange for more than 30 years. The company is a member of the Mexican Stock Exchange Sustainability Index and the sustainability emerging markets index FTSE4Good.

Prospective Information

In addition to historical information, this press release contains "forward-looking" statements that reflect management's expectations for the future. The words “anticipate,” “believe,” “expect,” “hope,” “have the intention of,” “might,” “plan,” “should” and similar expressions generally indicate comments on expectations. The final results may be materially different from current expectations due to several factors, which include, but are not limited to, global and local changes in politics, the economy, business, competition, market and regulatory factors, cyclical trends in relevant sectors; as well as other factors that are highlighted under the title “Risk Factors” on the annual report submitted by Mexichem to the Mexican National Banking and Securities Commission (CNBV). The forward-looking statements included herein represent Mexichem’s views as of the date of this press release. Mexichem undertakes no obligation to revise or update publicly any forward-looking statement for any reason unless required by law.”

Mexichem has implemented a Code of Ethics that rules our relationships with our employees, clients, suppliers and general groups. Mexichem’s Code of Ethics is available for consulting in the following link: http://www.mexichem.com/Codigo_de_etica.html. Additionally, according to the terms contained in the Securities Exchange Act No 42, Mexichem Audit Committee established a mechanism of contact, which allows that any person that knows the unfulfillment of operational and accounting records guidelines and lack of internal controls of the Code of Ethics, from the Company itself or from the subsidiaries that this controls, file a complaint which is anonymously guaranteed. The whistleblower program is facilitated by a third party. The telephone number in Mexico is 01-800-062-12-03. The website is http://www.ethic-line.com/mexichem and contact e-mail is mexichem@ethic-line.com. Mexichem’s Audit Committee will be notified of all complaints for immediate investigation.

INDEPENDENT ANALYSTS

EQUITY COVERAGE FROM THE LAST TWELVE MONTHS:

1. Actinver

2. Bank of America Merrill Lynch

3. Banorte-Ixe

4. Barclays

5. BBVA Bancomer

6. Bradesco

7. BTG Pactual

8. Citigroup

9. Credit Suisse

10. GBM-Grupo Bursátil Mexicano

11. Grupo Santander

12. HSBC

13. Intercam

14. Invex Casa de Bolsa

15. Interacciones

16. Itau

17. Morgan Stanley

18. UBS

19. Vector

20. Scotiabank

RECONCILIATION OF LEASE LIABILITIES

| Mexichem, S.A.B. de C.V. and Subsidiaries | |||

| Reconciliation of lease liabilities in millions US | |||

| Weighted average lessee’s incremental borrowing rate | 4.61% | ||

| 1/1/2019 | |||

| Off-balance lease obligation as of 12/31/2018 | 307 | ||

| (-) | Current leases with a lease term of 12 months or less (short-term leases) | -46 | |

| (-) | Leases of low-value-assets (low-value leases) | -5 | |

| (-) | Variable leases payments | - | |

| Operating lease obligations as of 01/01/2019 (gross, without discounting) | 256 | ||

| Operating lease obligations as of 01/01/2019 (net, discounted) | 208 | ||

| (+) | Reasonably certain extension or termination options | 44 | |

| (+) | Residual value guarantees | - | |

| (+) | Non-lease-components | - | |

| Lease liabilities due to initial application of IFRS 16 as of 01/01/2019 | 252 | ||

| (+) | Lease liabilities from finance leases as of 01/01/2019 | 33 | |

| Total lease liabilities as of 01/01/2019 | 285 | ||

INTERNAL CONTROL

Mexichem’s bylaws provide the existence of the Audit and Corporate Practices Committees, intermediate corporate organs constituted in agreement with the applicable law to assist the Board of Directors to carry on their functions. Through these committees and the external auditor, it is given reasonable safety that transactions and company’s acts are executed and registered in accordance with the terms and parameters set by the Board and directives of Mexichem, the applicable law and different general guidelines, criterion and IFRS (International Financial Reporting Standards).

View source version on businesswire.com: https://www.businesswire.com/news/home/20190424006157/en/