Know How a Petroleum Company Gained Additional Cash Flows of €3-4 Billion | SpendEdge’s Latest Engagement on Financial Risk Assessment

SpendEdge, a leading provider of procurement market intelligence solutions, has announced the completion of their latest engagement on financial risk assessment for a petroleum company.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190611005818/en/

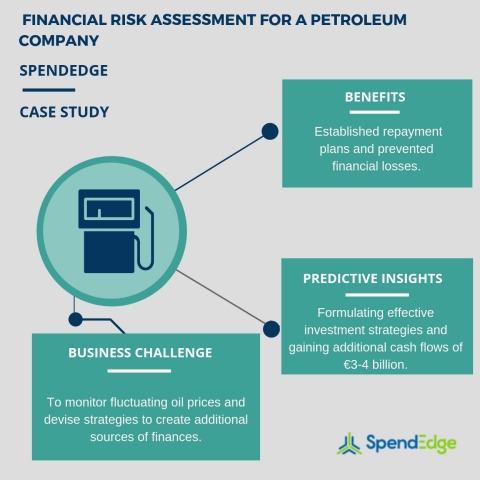

Financial risk assessment for a petroleum company. (Graphic: Business Wire)

Project background

The client wanted to obtain additional financing, increase cash flows, and improve their growth rate by expanding the operations. To do so, the client approached SpendEdge to leverage their expertise in conducting a financial risk assessment.

- Objective 1: The company wanted to develop the company's reserves to sustain planned expenditure.

- Objective 2: They also wanted to monitor fluctuating oil prices and devise strategies to create additional sources of finances accordingly.

- Want to know how conducting financial risk assessment can help companies to gain additional finances? Request a free proposal and access our complete portfolio of financial risk assessment solutions.

Solutions offered

In collaboration with SpendEdge, the client – a leading petroleum company in the UK – adopted a top-down approach and determined the maximum tolerable amounts of risk exposure that the company could address without facing significant losses. This helped them to optimize their risk profile and manage financial risks amidst weakening crude oil prices. The solution offered helped them to:

- Establish repayment plans and prevent financial losses.

- Formulate effective investment strategies and gain additional cash flows of €3-4 billion.

- Devising effective investment strategies requires detailed market insights. Request a free demo to know how our experts can provide real-time insights regarding the petroleum industry.

Key Takeaways

- Develop a repayment plan and avoid losses of €0.2-0.3 billion.

- Analyze customers’ doubtful account and set provisions for them.

- Monetize recent exploration successes and reserves improve financial stability.

- Determine policies and tools to manage the company’s exposure to financial risk.

- For more detailed insights into the solutions offered, request more information.

Outcome: The financial risk assessment conducted by the experts at SpendEdge helped the client to achieve financial flexibility by managing credit risks. The financial risk assessment solution further helped the client to analyze the impact of fluctuating crude oil prices in the growth of petroleum companies and devise strategies to sustain their position in the industry.

To access the complete case study on how we helped a petroleum company to conduct a financial risk assessment and gain additional cash flows, get in touch with our experts now!

About SpendEdge:

SpendEdge shares your passion for driving sourcing and procurement excellence. We are the preferred procurement market intelligence partner for 120+ Fortune 500 firms and other leading companies across numerous industries. Our strength lies in delivering robust, real-time procurement market intelligence reports and solutions.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190611005818/en/