Global Motor Lamination Market: COVID-19 Business Continuity Plan | Evolving Opportunities with Alinabal Inc. and Alliance Steel | Technavio

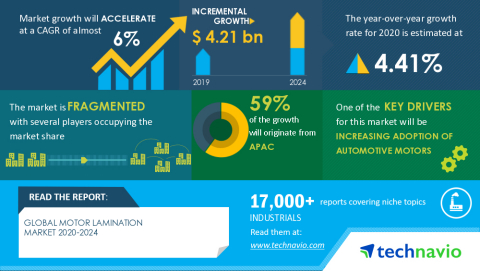

The global motor lamination market size is expected to grow by USD 4.21 billion as per Technavio. This marks a significant market growth compared to the 2019 growth estimates due to the impact of the COVID-19 pandemic in the first half of 2020. Moreover, steady growth is expected to continue throughout the forecast period, and the market is expected to grow at a CAGR of 6%. Request Free Sample Report on COVID-19 Impacts

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200920005032/en/

Technavio has announced its latest market research report titled Global Motor Lamination Market 2020-2024 (Graphic: Business Wire)

Read the 120-page report with TOC on "Motor Lamination Market Analysis Report by Material (Silicon steel, Cold rolled lamination steel, Cobalt alloys, Nickel alloys, and Others) and Geography (APAC, Europe, North America, MEA, and South America), and the Segment Forecasts, 2020-2024".

https://www.technavio.com/report/motor-lamination-market-industry-analysis

The market is driven by the increasing adoption of automotive motors. In addition, the growing popularity of in-wheel microdrive systems is anticipated to boost the growth of the Motor Lamination Market.

The increasing adoption of automotive motors will be one of the major drivers in the global motor lamination market during the forecast period. The rise in air pollution can be attributed to the fact that most of the fossil fuel-based vehicles emit harmful toxics. The adoption of electric vehicles (EVs) is an effective solution for resolving this issue as they use electric motors and electricity instead of an engine and fossil fuel. Governments are also offering financial incentives to encourage the purchase of EVs. Moreover, the hybrid segment is a prominent segment of the EVs market, owing to its scalability compared with other segments. The reduction in the price of hybrid passenger cars, technological improvements in hybrid and electric cars along with government initiatives are likely to increase the adoption of automotive motors, which in turn, will boost the demand for motor lamination.

Buy 1 Technavio report and get the second for 50% off. Buy 2 Technavio reports and get the third for free.

View market snapshot before purchasing

Major Five Motor Lamination Companies:

Alinabal Inc.

Alinabal Inc. has business operations under various segments such as Alinabal Engineered Products, Alinabal Motion Transfer Devices, DACO Instruments, and Practical Automation. The company offers rotors, stators, and end laminations of different sizes, ranging from 1/8" to 35".

Alliance Steel

Alliance Steel offers different types of steel including hot rolled steel, cold rolled steel, coated steel, pre-paint steel, and stainless steel. The company offers cold-rolled motor lamination steel, which is used to manufacture electrical equipment and components, small and large electric motors, home appliances, generators, and transformers.

Big River Steel LLC

Big River Steel LLC operates its business through two segments: niche products and standard products. The company offers cold-rolled motor lamination, which meets ASTM A726 standards for use in the electromagnetic core of fractional motors, and other electrical equipment and components.

EuroGroup Spa

EuroGroup Spa processes the highest quality raw materials such as electrical steel and offers fast prototyping capabilities and numerical simulation tools. The company offers high-quality motor lamination for electric motors and generators.

Orchid

Orchid has business operations under various segments such as electrical steel laminations, electric motor laminations, electric motors and generators cores, lamination tooling, power transformer cores, and standard products. The company offers electric motor lamination and generator lamination cores for various end-user applications, including household appliances, locomotives, wind turbines, and others.

Register for a free trial today and gain instant access to 17,000+ market research reports.

Technavio's SUBSCRIPTION platform

Motor Lamination Market Material Outlook (Revenue, USD bn, 2020-2024)

- Silicon steel - size and forecast 2019-2024

- Cold rolled lamination steel - size and forecast 2019-2024

- Cobalt alloys - size and forecast 2019-2024

- Nickel alloys - size and forecast 2019-2024

- Others - size and forecast 2019-2024

Motor Lamination Market Regional Outlook (Revenue, USD bn, 2020-2024)

- APAC - size and forecast 2019-2024

- Europe - size and forecast 2019-2024

- North America - size and forecast 2019-2024

- MEA - size and forecast 2019-2024

- South America - size and forecast 2019-2024

Technavio’s sample reports are free of charge and contain multiple sections of the report, such as the market size and forecast, drivers, challenges, trends, and more. Request a free sample report

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200920005032/en/