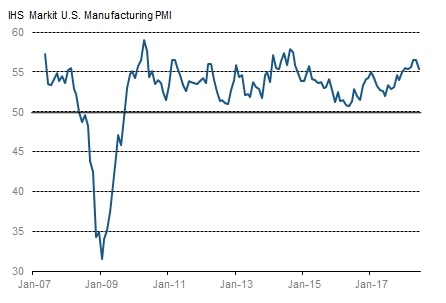

IHS Markit U.S. Manufacturing PMI™ – Final Data

June data signalled a slightly softer rate of growth across the U.S. manufacturing sector. The PMI dipped to its lowest in four months as output and new orders both expanded at the slowest rates since November 2017. Meanwhile, the effects of tariffs were widely cited as contributing to another sharp rise in input prices, while suppliers’ delivery times lengthened to the greatest extent since the series began. Average charges also increased sharply, rising at the second-fastest rate since June 2011.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180702005616/en/

IHS Markit U.S. Manufacturing PMI (Source: IHS Markit)

The seasonally adjusted IHS Markit final U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) registered 55.4 in June, down from 56.4 in May. The latest PMI reading was up from the ‘flash’ figure of 54.6 and ended the strongest quarterly performance since the third quarter of 2014.

Output growth remained strong in June, despite the rate of expansion easing to a seven-month low.

Similarly, the upturn in new orders was the softest since November 2017. Although the expansion lost some momentum, it was solid nonetheless. Panellists stated that growth was due to robust client demand and favourable market conditions. However, new business from abroad contracted for the first time since July 2017 (albeit only slightly), amid reports of weaker foreign client demand following recent tariff announcements.

The rate of input cost inflation was the slowest for four months, but remained sharp nonetheless. The rise in cost burdens was driven by greater global demand for inputs and the effects of recent tariffs. Supplier shortages were a key factor behind longer delivery times. Lead times for inputs lengthened to the greatest extent in the series history.

Factory gate prices also increased sharply, with the rate of inflation accelerating to the second-fastest since June 2011. Panellists widely commented that higher input costs were partly passed onto clients.

Reflective mainly of difficulties in sourcing raw materials, buying activity and stocks of purchases grew at weaker rates in June.

Capacity pressures persisted, despite employment growth quickening since May, as backlogs increased solidly. The rate of job creation was the fastest since February and outstanding business rose at the second-strongest rate since September 2015.

Business confidence was strong in June. Optimism was commonly linked to expected sustained upturns in output and new orders. That said, sentiment fell to the lowest level for five months.

Comment

Commenting on the final PMI data, Chris Williamson, Chief Business Economist at IHS Markit said:

“The PMI for June rounds off the best quarter for manufacturing for almost four years, but also fires some warning shots about what lies ahead. As such, the second quarter could represent a peak in the production cycle.

“The survey has a good track record of accurately anticipating changes in the official manufacturing output data, and suggests the goods-producing sector is growing at an annualised rate of around 2.5%.

“On the downside, new orders inflows were the weakest for seven months, with rising domestic demand countered by a drop in export sales for the first time since July of last year. Business optimism about the year ahead also fell to the lowest since January, with survey respondents worried in particular about the potential impact of trade wars and tariffs.

“Tariffs were widely blamed on a further marked rise in input costs, and also linked to worsening supply chain delays – which hit the highest on record, exacerbating existing tight supply conditions.”

Note to Editors:

IHS Markit originally began collecting monthly Purchasing Managers' Index™ (PMI™) data in the U.S. in April 2004, initially from a panel of manufacturers in the U.S. electronics goods producing sector. In May 2007, IHS Markit’s U.S. PMI research was extended out to cover producers of metal goods. In October 2009, IHS Markit’s U.S. Manufacturing PMI survey panel was extended further to cover all areas of U.S. manufacturing activity. Back data for IHS Markit’s U.S. Manufacturing PMI between May 2007 and September 2009 are an aggregation of data collected from producers of electronic goods and metal goods producers, while data from October 2009 are based on data collected from a panel representing the entire U.S. manufacturing economy. IHS Markit’s total U.S. Manufacturing PMI survey panel comprises over 600 companies.

The panel is stratified by North American Industrial Classification System (NAICS) group and company size, based on industry contribution to U.S. GDP. Survey responses reflect the change, if any, in the current month compared to the previous month based on data collected mid-month. For each of the indictors the ‘Report’ shows the percentage reporting each response, the net difference between the number of higher/better responses and lower/worse responses, and the ‘diffusion’ index. This index is the sum of the positive responses plus a half of those responding ‘the same’.

The Purchasing Managers’ Index™ (PMI™) is a composite index based on five of the individual indexes with the following weights: New Orders – 0.3, Output – 0.25, Employment – 0.2, Suppliers’ Delivery Times – 0.15, Stocks of Items Purchased – 0.1, with the Delivery Times Index inverted so that it moves in a comparable direction.

Diffusion indexes have the properties of leading indicators and are convenient summary measures showing the prevailing direction of change. An index reading above 50 indicates an overall increase in that variable, below 50 an overall decrease.

IHS Markit do not revise underlying survey data after first publication, but seasonal adjustment factors may be revised from time to time as appropriate which will affect the seasonally adjusted data series. Historical data relating to the underlying (unadjusted) numbers, first published seasonally adjusted series and subsequently revised data are available to subscribers from IHS Markit. Please contact economics@ihsmarkit.com.

About IHS Markit (www.ihsmarkit.com)

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and expertise to forge solutions for customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions.

IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates. All other company and product names may be trademarks of their respective owners © 2018 IHS Markit Ltd. All rights reserved.

About PMI

Purchasing Managers’ Index™ (PMI™) surveys are now available for over 40 countries and also for key regions including the eurozone. They are the most closely-watched business surveys in the world, favoured by central banks, financial markets and business decision makers for their ability to provide up-to-date, accurate and often unique monthly indicators of economic trends. To learn more go to www.ihsmarkit.com/products/pmi.

The intellectual property rights to the U.S. Manufacturing PMI™ provided herein are owned by or licensed to IHS Markit. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without IHS Markit’s prior consent. IHS Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall IHS Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trade marks of Markit Economics Limited or licensed to Markit Economics Limited. IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates.

View source version on businesswire.com: https://www.businesswire.com/news/home/20180702005616/en/