Escalating Proppant Intensity and Rising CAPEX in U.S. Oil and Gas Operations Driving ‘Extreme’ Demand Growth for Frack Sand, IHS Markit Says

Sustained oil and gas exploration and production activity growth, coupled with rising U.S. CAPEX investment and escalating proppant intensity–per-lateral-foot—especially in the Permian Basin—is driving ‘extreme’ demand growth for proppant (frack) sand, according to a new report from business information provider IHS Markit (Nasdaq: INFO). The report, entitled IHS Markit ProppantIQ 2Q2018 Analysis, says the current market value for frack sand exceeds $4 billion in 2018, and will reach nearly $6 billion by 2023. By comparison, the market value for proppant sand in 2016 was $1.3 billion.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180822005117/en/

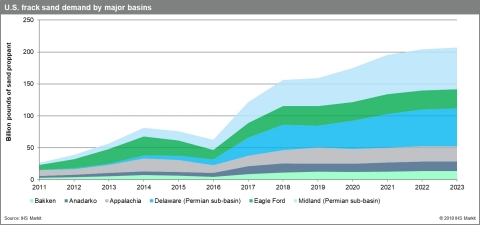

U.S. frack sand demand by major basin. Source: IHS Markit

During drilling and completion operations in shale-rock formations, a proppant (usually frack sand), along with water, is pumped down a well under extremely high pressure to fracture and ’prop open’ tight source rocks residing deep below the surface. This action forces the rocks to release their trapped hydrocarbons, which then flow up the well to the surface.

There are generally two types of sand used in oil and gas completion operations, northern white sand (NWS) and brown or regional sand. Northern white is considered premium and is mined in several Midwestern states, primarily in Minnesota, Wisconsin and Illinois. Brown sand is considered lesser-quality sand, but it is less expensive and is mined in Texas, closer to most oil and gas operations. Increasingly, regional or brown sand is being mined within the Permian Basin itself, reducing significantly the transportation costs, delivery times, and competition for supply.

Total North American proppant demand, which includes sand as well as resin-coated sand (RCS) and ceramic, is expected to exceed 168 billion pounds in 2018, representing a 27 percent year-over-year growth (2Q 2017 compared to 2Q 2018), according to the IHS Markit ProppantIQ 2Q2018 Analysis. However, most of this demand is for sand, which accounts for 162 billion pounds (about 96 percent) of total North American proppant demand in 2018. Sand demand growth is nearly 29 percent year-over-year, for 2Q 2017 to 2Q 2018, IHS Markit said.

By 2023, North American frack-sand demand will reach an estimated 231 billion pounds, representing an increase of 113 percent above peak demand levels for 2014, IHS Markit said. By contrast, the market for frack sand for U.S. onshore oil and gas operations in 2011 was slightly more than 51 billion pounds.

“Sand proppant demand is at record highs—the growth rate is extreme by any measure,” said Brandon Savisky, senior market research analyst, cost and technology at IHS Markit and author of the IHS Markit ProppantIQ 2Q2018 Analysis. “We expect it will continue to expand at an estimated current annual growth rate of approximately 16 percent by 2023, with the Permian Basin leading the pack in terms of North American frack-sand demand. The basin accounts for nearly 40 percent of the market demand, but by 2023, the Permian Basin will account for almost 50 percent of proppant sand demand,” Savisky said.

Increased sand demand is closely tied to the increased capital spending that is occurring in the Permian, Savisky said. Onshore U.S. E&P CAPEX is estimated to be approximately $97 billion in 2018 (nearly 45 percent of total CAPEX is deployed in the Permian Basin), and will reach an estimated $117 billion in 2020.

According to the IHS Markit analysis, more than 70 percent of the entire North American proppant demand derives from three plays—the Permian, Appalachia, and Eagle Ford, and these three plays will account for 75 percent of the market by 2020.

Canadian demand accounts for nearly 4 percent of North American frack-sand demand in 2018 and will drop only slightly by 2023. In 2018, 65 percent of Canadian demand for proppant sand originates from the Montney, Duvernay and Deep Basin plays.

Much of the sand demand growth is attributed to an increase in proppant intensity-per-lateral-foot; operators are also drilling longer laterals and increasing stage counts, IHS Markit said. In addition to more sand use in terms of volume per-frack per lateral foot, the mesh size of the sand used has gotten finer, particularly in the Permian Basin, so more sand is required.

During the oil price downturn of 2014 through 2016, operators were pressed to cut operating costs to improve economics and simply survive, Savisky said. One of those cost reductions was the decision by the technology leaders in the shale plays to reduce or even eliminate the use of coated or ceramic proppant in favor of cheaper, more abundant (plain) sand. Frack sand is the lowest cost proppant available, even at the fine mesh sizes demanded today.

“Ironically, that choice, and an adjustment in the formula toward larger volumes of finer-mesh sands, enabled many producers to maintain production levels, and in some cases to boost production, so cost-saving efforts drove innovation that has now become the preferred completion model,” Savisky said. “However, most Permian operators are still tweaking their completion designs as they search for an inflection point to identify any points of diminishing returns.”

“Capital efficiency has improved dramatically since 2014. However, expected well-cost increases should result in reduced capital efficiency across all plays during 2018,” Savisky said. “Although cost reflation hurts the Permian Basin during 2018, continued well productivity improvements, as well as abundant core inventory, suggest that capital efficiency will gradually improve in subsequent years, which is good news for the sector as a whole.”

Costly supply chain constraints, particularly in the Permian Basin, have been such an ongoing issue that operators are actively working with vendors across their supply chains to address bottlenecks and drive down costs, the IHS Markit report said. In the sand market, IHS Markit said investments are being made in self-sourcing, where oil and gas operators actually own the mine, or through partnerships or direct sourcing, where sand-mining companies purchase the storage and transportation assets to ensure greater efficiency and cost containment from the mine to the wellhead.

“Transportation costs continue to comprise more than 65 percent of sand costs, so reducing those costs and securing supply are very valuable to operators,” Savisky said. “The cost (of sand) landed at the well site is heavily weighted on the logistics premiums, so transportation, coupled with proximity of supply and storage, is valuable to operators trying to manage both cost and supply chain risk.”

IHS Markit said that regional and Texas brown sands have a surge in investment capacity being built or announced; however, challenges related to infrastructure and water availability will continue to plague the sector.

Overall, IHS Markit anticipates the pricing for both NWS and regional sands to continue to be relatively flat with small short-term spot-market fluctuations for the remainder of 2018. IHS Markit said the sand market is currently slightly to moderately over-supplied, with operators still demanding NWS.

The North American sand market is dominated by several companies, including Covia Holdings (formerly FMSA -- Fairmount Santrol/Unimin); US Silica (SLCA); Hi-Crush Proppants; Emerge Energy Services, Black Mountain Sands, Atlas/Badger Mining Corp; Hexion; CARBO Ceramics; Preferred Sands; Vista Sand; Source Energy Services and Smart Sands. Covia Holdings was a recent, large merger of two of the biggest proppant and sand providers – Fairmount Santrol and Unimin. The Hi-Crush Proppants acquisition of FB Industries is an example of a recent vertical integration to incorporate “last-mile” logistics, as a means of helping further decrease costs, IHS Markit said.

To speak with Brandon Savisky, please contact Melissa Manning at melissa.manning@ihsmarkit.com. For more information on the IHS Markit ProppantIQ 2Q2018 Analysis, contact clare.fletcher@ihsmarkit.com.

About IHS Markit (www.ihsmarkit.com)

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions. Headquartered in London, IHS Markit is committed to sustainable, profitable growth.

IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates. All other company and product names may be trademarks of their respective owners. © 2018 IHS Markit Ltd. All rights reserved.

View source version on businesswire.com: https://www.businesswire.com/news/home/20180822005117/en/