Leveraging AI, IHS Markit Delivers Industry’s Most Accurate, Comprehensive Production Forecast Analytics for Every Producing Oil and Gas Well in North America

IHS Markit has harnessed the power of artificial intelligence (AI) to assess, automate and predict future production for each of the nearly one million currently producing oil and gas wells in its North American databases—the first time this technology has been leveraged to forecast well-by-well future production for the industry’s most accurate, comprehensive source of commercial oil and gas data, according to global business information provider IHS Markit (NYSE: INFO).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190903005825/en/

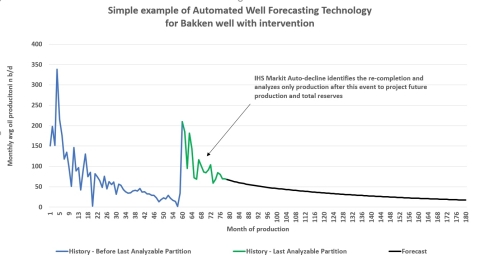

IHS Markit (NYSE:INFO) has, for the first time, harnessed the power of artificial intelligence (AI) to assess, automate and predict future production for each of the nearly one million currently producing oil and gas wells in its North American databases, yielding important insights into future production. Pictured here is a well analysis from the Bakken formation in the Williston Basin underlying Montana, North Dakota, Saskatchewan and Manitoba. (Graphic: Business Wire)

The results are telling—North American onshore base oil-production decline rates are extremely rapid—existing onshore producing wells will decline by 35% during the next 12 months. This compares with base decline rates of 5% to 14% for most petroleum systems globally during the same period, and a base decline rate of less than 15% a decade ago in the U.S.

As a result, it is going to be costly for companies just to keep production flat, according to analysis of the data from the new IHS Markit Automated Well Forecasting Technology. The evaluation assessed the entire North American production system, including both conventional and unconventional wells across the system. The results have yielded important insights into the challenges facing E&P companies. IHS Markit says it can leverage the technology to conduct similar assessments of other producing wells and systems globally, but started with North America, due to the significant level of detail in the data and the focus of investment in the region.

The North American onshore base production-decline rates are accelerating in both absolute and percentage terms. Comparing 2017 to 2019, IHS Markit calculates that the onshore oil base decline nearly doubled (measured by the production drop from January through December of a given year, without accounting for wells added by new capital). Base production declined by 1.8 million barrels of oil per day or 28% in 2017, but will fall by 3.5 million barrels of oil per day or 35% in 2019.

"The treadmill that producers are fighting is moving very fast," said Raoul LeBlanc, vice president of North American Unconventional Oil and Gas at IHS Markit. "As producers come under pressure to restrain investment, this decline rate is becoming the main factor that promises to slow the explosive U.S. production growth we’ve witnessed the past few years.”

Predicting well productivity and estimating reserves has long been the lifeblood of oil and gas companies, LeBlanc said, since reserves estimates are a key metric in assessing the company’s value and future performance. Operators use detailed internal data to model their own wells, but engineers face limited information and arduous workflows when trying to quickly benchmark against competitors or screen for acquisitions.

“Most engineers don’t have the time they once did to conduct in-depth, well-level, decline-curve analysis on a handful of wells, so the prospect of rapidly analyzing thousands of wells is attractive, and we’ve delivered that analysis for nearly one million wells,” said Russell Roundtree, vice president of Upstream Data Analytics at IHS Markit. “This derived dataset becomes an invaluable addition to the oil and gas community and to financial investors who need to assess a company’s risk and future performance.”

The IHS Markit analysis of well decline behavior across the system revealed important conclusions about the current shale-dominated system.

- Despite the breathtaking plunge of 65% to 85% in first-year production declines that most young wells take, in a steady state, closed system, the dynamic (of steep declines) is sustainable because high-initial productivity offsets steep absolute declines

- Individual onshore U.S. wells drilled today, with a few exceptions, follow a similar decline path as neighboring wells drilled in the past. In other words, companies are not “pulling” wells harder, and much more intensive hydraulic fracturing is not generally leading to faster decline rates

- The base-decline rates for North American assets vary directly with the production-weighted age of the well base. In other words, the overall base decline will vary significantly depending on how rapidly production expanded in the previous one to two years

“Due to their unique producing portfolios, companies today are in very different positions relative to their current base-decline rates,” LeBlanc said. “The danger of high well production decline rates is two-fold—namely vulnerability and degradation in production efficiency. Vulnerability involves anything leading to materially reduced completion activity, such as a price drop, weather, or a financing crisis. Volatility and quality degradation are the real threats,” LeBlanc said.

In developing the IHS Markit Automated Well Forecasting Technology, IHS Markit was able to leverage the infrastructure of its industry-leading Harmony™ reserves estimation and engineering software. The enhanced North American reserves-decline analysis is derived from the IHS Markit Automated Well Forecasting Technology, and the analysis is currently delivered to IHS Markit customers through its Performance Evaluator™ analytics platform.

A vital benefit of having individual well analysis is those analyses can be used to assess play, reservoir, field, company, competitor performance and future production, and resulting assessments can be validated down to the well level, IHS Markit said. The well-level analysis is particularly critical in unconventional wells, where many technical and geologic variables can exist, and it is more accurate to aggregate a set of individually forecasted wells than to aggregate historical information and then make a forecast.

The AI-based tool uses “smart” technology—meaning it ‘learns’ from adjacent wells in the same reservoir to improve its accuracy of forecasting. Another capability that mimics human behavior in terms of well analysis is the critical process of partitioning a well’s history over time to more accurately assess its future performance.

At some point in the life of a well, which usually spans decades, there will be intervention—a workover, re-stimulation, pump installation, which often changes the production trend of the well. A viable reserve-estimation process must account for how these major “life-events” change the total reserves estimation. The IHS Markit Automated Well Forecasting Technology detects changes to production patterns—those often too difficult for humans to see—and makes a forecast using only relevant data. The technology is smart enough to recognize interventions and to compensate for them.

For more information on the analysis of the data from the new IHS Markit Automated Well Forecasting Technology and Performance Evaluator™, please contact Jenny Salinas. To speak with Raoul LeBlanc or Russell Roundtree, please contact Melissa Manning.

About IHS Markit (www.ihsmarkit.com)

IHS Markit (NYSE: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. Headquartered in London, IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions.

IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates. All other company and product names may be trademarks of their respective owners © 2019 IHS Markit Ltd. All rights reserved.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190903005825/en/