COVID-19 Impact and Recovery Analysis | Invisible Orthodontics Market in North America 2020-2024 | Increasing Incidence Of Dental Conditions to Boost Growth | Technavio

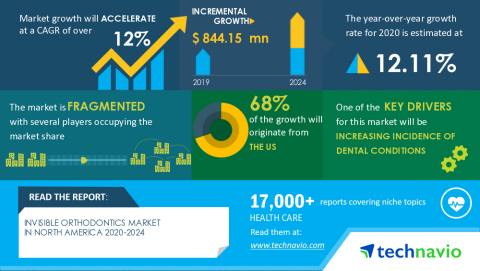

Technavio has been monitoring the invisible orthodontics market in North America and it is poised to grow by USD 844.15 mn during 2020-2024, progressing at a CAGR of 12% during the forecast period. The report offers an up-to-date analysis regarding the current market scenario, latest trends and drivers, and the overall market environment.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200506005513/en/

Technavio has announced its latest market research report titled Invisible Orthodontics Market in North America 2020-2024 (Graphic: Business Wire)

Technavio suggests three forecast scenarios (optimistic, probable, and pessimistic) considering the impact of COVID-19. Please Request Latest Free Sample Report on COVID-19 Impact

The market is fragmented, and the degree of fragmentation will accelerate during the forecast period. 3M Co., Align Technology Inc., Altaris Capital Partners LLC, American Orthodontics Corp., Danaher Corp., DENTSPLY SIRONA Inc., Henry Schein Inc., Straumann Holding AG, and TP Orthodontics Inc, are some of the major market participants. Although the increasing incidence of dental conditions will offer immense growth opportunities, high costs associated with orthodontic procedures will challenge the growth of the market participants. To make the most of the opportunities, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

Increasing incidence of dental conditions has been instrumental in driving the growth of the market. However, high costs associated with orthodontic procedures might hamper market growth.

Invisible Orthodontics Market in North America 2020-2024 : Segmentation

Invisible Orthodontics Market in North America is segmented as below:

-

Product

- Clear Aligners

- Ceramic Braces

- Lingual Braces

-

End-user

- Dental Clinic

- Hospitals

-

Geographic Landscape

- The US

- Canada

- Mexico

- Rest Of North America

To learn more about the global trends impacting the future of market research, download a free sample: https://www.technavio.com/talk-to-us?report=IRTNTR40030

Invisible Orthodontics Market in North America 2020-2024 : Scope

Technavio presents a detailed picture of the market by the way of study, synthesis, and summation of data from multiple sources. Our invisible orthodontics market in North America report covers the following areas:

- Invisible Orthodontics Market in North America Size

- Invisible Orthodontics Market in North America Trends

- Invisible Orthodontics Market in North America Industry Analysis

This study identifies digitization driven by CAD/CAM technology as one of the prime reasons driving the invisible orthodontics market growth in North America during the next few years.

Invisible Orthodontics Market in North America 2020-2024 : Vendor Analysis

We provide a detailed analysis of around 25 vendors operating in the invisible orthodontics market in North America, including some of the vendors such as 3M Co., Align Technology Inc., Altaris Capital Partners LLC, American Orthodontics Corp., Danaher Corp., DENTSPLY SIRONA Inc., Henry Schein Inc., Straumann Holding AG, and TP Orthodontics Inc. Backed with competitive intelligence and benchmarking, our research reports on the invisible orthodontics market in North America are designed to provide entry support, customer profile and M&As as well as go-to-market strategy support.

Register for a free trial today and gain instant access to 17,000+ market research reports.

Technavio's SUBSCRIPTION platform

Invisible Orthodontics Market in North America 2020-2024 : Key Highlights

- CAGR of the market during the forecast period 2020-2024

- Detailed information on factors that will assist the invisible orthodontics market growth in North America during the next five years

- Estimation of the invisible orthodontics market size and its contribution to the parent market in North America

- Predictions on upcoming trends and changes in consumer behavior

- The growth of the invisible orthodontics market in North America

- Analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of the invisible orthodontics market vendors in North America

Table Of Contents :

PART 01: EXECUTIVE SUMMARY

PART 02: SCOPE OF THE REPORT

- 2.1 Preface

- 2.2 Preface

- 2.3 Currency conversion rates for US$

PART 03: MARKET LANDSCAPE

- Market ecosystem

- Market characteristics

- Value chain analysis

- Market segmentation analysis

PART 04: MARKET SIZING

- Market definition

- Market sizing 2019

- Market size and forecast 2019-2024

- Market outlook

PART 05: FIVE FORCES ANALYSIS

- Bargaining power of buyers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Threat of rivalry

- Market condition

PART 06: MARKET SEGMENTATION BY PRODUCT

- Market segmentation by product

- Comparison by product

- Clear aligners - Market size and forecast 2019-2024

- Ceramic braces - Market size and forecast 2019-2024

- Lingual braces - Market size and forecast 2019-2024

- Market opportunity by product

PART 07: CUSTOMER LANDSCAPE

PART 08: MARKET SEGMENTATION BY END-USER

- Dental clinics

- Hospitals

PART 09: GEOGRAPHIC LANDSCAPE

- Geographic segmentation

- Geographic comparison

- US - Market size and forecast 2019-2024

- Canada - Market size and forecast 2019-2024

- Mexico - Market size and forecast 2019-2024

- Rest of North America - Market size and forecast 2019-2024

- Market opportunity

PART 10: DECISION FRAMEWORK

PART 11: DRIVERS AND CHALLENGES

- Market drivers

- Market challenges

PART 12: MARKET TRENDS

- Digitization driven by CAD/CAM technology

- Growing presence of dental laboratories

- Increasing popularity of invisible orthodontics among teenagers

PART 13: VENDOR LANDSCAPE

- Overview

- Landscape disruption

- Competitive scenario

PART 14: VENDOR ANALYSIS

- Vendors covered

- Vendor classification

- Market positioning of vendors

- 3M Co.

- Align Technology, Inc.

- Altaris Capital Partners LLC

- American Orthodontics Corp.

- Danaher Corp.

- DENTSPLY SIRONA, Inc.

- Henry Schein, Inc.

- Straumann Holding AG

- TP Orthodontics, Inc.

PART 15: APPENDIX

- Research methodology

- List of abbreviations

- Definition of market positioning of vendors

PART 16: EXPLORE TECHNAVIO

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200506005513/en/