Ingevity reports selected preliminary third quarter 2020 financial results

Ingevity Corporation (NYSE:NGVT) today reported selected preliminary financial results for the third quarter.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20201020005627/en/

Ingevity Corporation (NYSE:NGVT) today reported selected preliminary financial results for the third quarter.

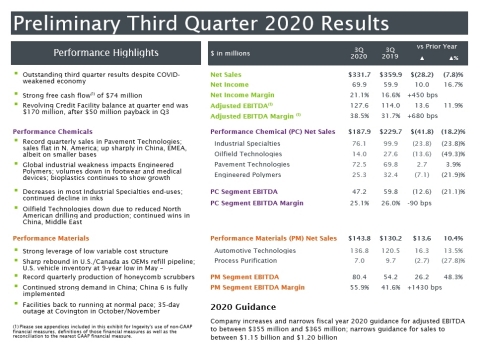

“Ingevity’s third quarter results were driven by strong rebounds in automotive sales and production worldwide versus a weak second quarter, along with continued strong paving activity, cost reduction actions and strong execution,” said John Fortson, president and CEO. “These positives were partially offset by a weakened economic environment due to COVID-19 that particularly impacted our Performance Chemicals businesses. Nonetheless, our adjusted EBITDA and adjusted EBITDA margin were records for the third quarter.”

Third quarter net sales of $332 million were down 7.8% versus the prior year third quarter. Net income of $70 million increased 16.7% and net income margin of 21.1% was up from 16.6% in the prior year. The third quarter diluted earnings per share were $1.69 compared to $1.41 in the prior year period.

Adjusted earnings of $74 million were up 19.3% versus the prior year quarter. Diluted adjusted earnings per share were $1.79, which exclude, net of tax, $0.10 related primarily to restructuring and other charges, net, recognized during the quarter. This compares to diluted adjusted earnings per share of $1.46 in the prior year quarter. Adjusted EBITDA of $128 million were up 11.9% versus the third quarter 2019. Adjusted EBITDA margin of 38.5% was up 680 basis points from the prior year’s third quarter.

The company generated operating cash flow of $90 million, which translated to free cash flow of $74 million.

Performance Chemicals

“With the exception of our pavement technologies business, our Performance Chemicals segment was negatively impacted by a weak economy resulting from COVID-19,” said Fortson. “We continue to control costs which resulted in our adjusted EBITDA margins remaining solidly in the mid 20s.”

Sales to pavement technologies applications were slightly higher than the prior year and set a quarterly record. While paving sales in North America were essentially flat, sales in China and Europe, Middle East and Africa (EMEA) were up sharply, albeit from smaller bases. Sales for engineered polymers products were down due to reduced industrial demand globally. Footwear and medical device sales were down, while sales to bioplastics customers continued to show growth. Sales decreased in industrial specialties applications due to continued demand weakness for printing inks and other end-use applications. Additionally, sales to oilfield technologies customers were cut sharply in line with reduced drilling in North America; sales in oil production applications were down moderately.

Third quarter 2020 sales in the Performance Chemicals segment were $188 million, down 18.2% versus the third quarter 2019. Segment EBITDA were $47 million, down 21.1% versus the prior year quarter due to lower volumes which were partially offset by price/mix. Segment EBITDA margin declined 90 basis points to 25.1%.

Performance Materials

“Automakers – particularly in the U.S. and Canada – rebounded sharply,” said Fortson. “The industry continues to work to refill the vehicle pipeline, and as such, demand for our gasoline vapor emission control solutions has risen dramatically versus the second quarter.” As a result, the company’s quarterly production of honeycomb scrubbers used to meet the U.S. and Canadian regulatory standards were a quarterly record.

Sales of Performance Materials products in China were up strongly as automakers there have bounced back from COVID-related shutdowns and the implementation of the China 6 standard has been completed.

Third quarter 2020 sales in the Performance Materials segment were $144 million, up 10.4% versus the third quarter 2019. Segment EBITDA were $80 million, up 48.3% versus the prior year period due to the sharp increase in volumes and price/mix improvement. Segment EBITDA margin increased 1,430 basis points to 55.9%.

Outlook

Ingevity narrowed its fiscal year 2020 guidance for sales from between $1.10 billion and $1.20 billion to between $1.15 billion and $1.20 billion, and increased and narrowed its guidance for adjusted EBITDA from between $310 million and $350 million to between $355 million and $365 million.

“We remain confident in our business through the end of the year,” said Fortson. “While we may see continued weakness on the revenue line, given the cost controls we’ve implemented, we expect our adjusted EBITDA and adjusted EBITDA margins to remain favorable. And while uncertainty remains regarding global economic strength, we believe in the strength of our strategy and our team’s ability to execute on the opportunities.”

Preliminary Results

We have provided the preliminary estimated financial results contained in this press release and the accompanying financial schedules because our financial closing procedures for the three months ended September 30, 2020 are not yet complete. The preliminary estimated financial information contained herein and in the accompanying financial schedules does not represent a comprehensive statement of our results of operations or financial condition as of or for the three months ended September 30, 2020 and is based solely on information available to us as of the date of this press release. Our results of operations and financial condition as of and for the three months ended September 30, 2020 may vary from our current expectations and may be different from the information described above as our quarterly financial statement preparation process is not yet complete and additional developments and adjustments may arise between now and the time the financial statements and other disclosures for this period are finalized, including all disclosures required by GAAP. In addition, these preliminary estimated financial results are not necessarily indicative of the results to be achieved for the remainder of 2020 or in any future period. There can be no assurance that these estimates will be realized, and estimates are subject to risks and uncertainties, many of which are not within our control. The information contained herein and in the accompanying financial schedules should not be viewed as a substitute for full financial statements prepared in accordance with GAAP or as a measure of performance. Accordingly, you should not place undue reliance on such financial information.

Ingevity: Purify, Protect and Enhance

Ingevity provides specialty chemicals, high-performance carbon materials and engineered polymers that purify, protect and enhance the world around us. Through a team of talented and experienced people, Ingevity develops, manufactures, and brings to market products and processes that help customers solve complex problems. These products are used in a variety of demanding applications, including asphalt paving, oil exploration and production, agrochemicals, adhesives, lubricants, publication inks, coatings, elastomers, bioplastics and automotive components that reduce gasoline vapor emissions. Headquartered in North Charleston, South Carolina, Ingevity operates from 25 locations around the world and employs approximately 1,850 people. The company is traded on the New York Stock Exchange (NYSE: NGVT). For more information visit www.ingevity.com.

Additional Information

The company will host a live webcast on Thursday, Oct. 29, 2020, at 10 a.m. (Eastern Time) to discuss third quarter 2020 fiscal results. The webcast can be accessed through the investors section of Ingevity’s website. You may also listen to the conference call by dialing 877-407-2991 (inside the U.S.) or 201-389-0925 (outside the U.S.), at least 10 minutes prior to the start of the event. Information on how to access the webcast and conference call, along with a slide deck containing other relevant financial and statistical information, will be posted to the investors section of Ingevity’s website prior to the call. For those unable to join the live event, a replay of the webcast will be available beginning at approximately 2 p.m. (Eastern Time) on Oct. 29, 2020, through Nov. 29, 2020.

Use of Non-GAAP Financial Measures

Ingevity has presented certain financial measures which have not been prepared in accordance with U.S. generally accepted accounting principles (GAAP). Definitions of our non-GAAP financial measures and a reconciliation to the most directly comparable financial measure calculated in accordance with GAAP are included in the financial schedules accompanying this news release, under the section entitled "Non-GAAP Financial Measures."

Cautionary Statements About Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Such statements generally include the words “will,” “plans,” “intends,” “targets,” “expects,” “outlook,” or similar expressions. Forward-looking statements may include, without limitation, expected financial positions, results of operations and cash flows; financing plans; business strategies and expectations; operating plans; impact of COVID-19; synergies and the potential benefits of the acquisition of Perstorp Holding AB’s Capa® caprolactone business (the “acquisition”); capital and other expenditures; competitive positions; growth opportunities for existing products; benefits from new technology and cost-reduction initiatives, plans and objectives; markets for securities and expected future repurchases of shares, including statements about the manner, amount and timing of repurchases. Actual results could differ materially from the views expressed. Factors that could cause actual results to materially differ from those contained in the forward-looking statements, or that could cause other forward-looking statements to prove incorrect, include, without limitation, adverse effects from the COVID-19 pandemic; risks that the expected benefits from the acquisition may not be realized or will not be realized in the expected time period, the risk that the acquired business will not be integrated successfully and the risk of significant transaction costs and unknown or understated liabilities; adverse effects of general economic and financial conditions; risks related to international sales and operations; impacts of currency exchange rates and currency devaluation; compliance with U.S. and foreign regulations concerning our operations outside the U.S.; changes in trade policy, including the imposition of tariffs; the impact of the United Kingdom’s withdrawal from the European Union; attracting and retaining key personnel; adverse conditions in the global automotive market or adoption of alternative and new technologies; competition from producers of alternative products and new technologies, and new or emerging competitors; competition from infringing intellectual property activity; worldwide air quality standards; a decrease in government infrastructure spending; declining volumes and downward pricing in the printing inks market; the limited supply of or lack of access to sufficient crude tall oil; a prolonged period of low energy prices; the provision of services by third parties at several facilities; natural disasters, such as hurricanes, winter or tropical storms, earthquakes, tornados, floods, fires; other unanticipated problems such as labor difficulties, equipment failure or unscheduled maintenance and repair; protection of intellectual property and proprietary information; information technology security breaches and other disruptions; complications with designing and implementing our new enterprise resource planning system; government policies and regulations, including, but not limited to, those affecting the environment, climate change, tax policies, tariffs and the chemicals industry; and lawsuits arising out of environmental damage or personal injuries associated with chemical or other manufacturing processes, and the other factors detailed from time to time in the reports we file with the SEC, including those described under "Risk Factors" in our Annual Report on Form 10-K, our Form 10-Q for the period ending March 31, 2020 and other periodic filings. These forward-looking statements speak only as of the date of this press release. Ingevity assumes no obligation to provide any revisions to, or update, any projections and forward-looking statements contained in this press release.

Ingevity has presented certain financial measures, defined below, which have not been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and has provided a reconciliation to the most directly comparable financial measure calculated in accordance with GAAP on the following pages. These financial measures are not meant to be considered in isolation or as a substitute for the most directly comparable financial measure calculated in accordance with GAAP. Investors should consider the limitations associated with these non-GAAP measures, including the potential lack of comparability of these measures from one company to another.

We believe these non-GAAP financial measures provide management as well as investors, potential investors, securities analysts and others with useful information to evaluate the performance of the business, because such measures, when viewed together with our financial results computed in accordance with GAAP, provide a more complete understanding of the factors and trends affecting our historical financial performance and projected future results.

Ingevity uses the following non-GAAP measures:

Adjusted earnings (loss) is defined as net income (loss) plus restructuring and other (income) charges, net, acquisition and other-related costs, pension and postretirement settlement and curtailment (income) charges and the income tax expense (benefit) on those items, less the provision (benefit) from certain discrete tax items.

Diluted adjusted earnings (loss) per share is defined as diluted earnings (loss) per common share plus restructuring and other (income) charges, net per share, acquisition and other-related costs per share, pension and postretirement settlement and curtailment (income) charges per share and the income tax expense (benefit) per share on those items, less the per share tax provision (benefit) from certain discrete tax items per share.

Adjusted EBITDA is defined as net income (loss) plus provision (benefit) for income taxes, interest expense, net, depreciation and amortization, restructuring and other (income) charges, net, acquisition and other-related costs, and pension and postretirement settlement and curtailment (income) charges.

Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by Net sales.

Free Cash Flow is defined as the sum of cash provided by (used in) the following items: operating activities less capital expenditures.

Ingevity also uses the above financial measures as the primary measures of profitability used by managers of the business. In addition, Ingevity believes Adjusted EBITDA and Adjusted EBITDA Margin are useful measures because they exclude the effects of financing and investment activities as well as non-operating activities.

GAAP Reconciliation of 2020 Adjusted EBITDA Guidance

A reconciliation of net income to adjusted EBITDA as projected for 2020 is not provided. Ingevity does not forecast net income as it cannot, without unreasonable effort, estimate or predict with certainty various components of net income. These components, net of tax, include further restructuring and other income (charges), net; additional acquisition and other-related costs in connection with the acquisition of Perstorp Holding AB’s Capa caprolactone business; additional pension and postretirement settlement and curtailment (income) charges; and revisions due to future guidance and assessment of U.S. tax reform. Additionally, discrete tax items could drive variability in our projected effective tax rate. All of these components could significantly impact such financial measures. Further, in the future, other items with similar characteristics to those currently included in adjusted EBITDA, that have a similar impact on comparability of periods, and which are not known at this time, may exist and impact adjusted EBITDA.

Ingevity Corporation |

||||||||

Non-GAAP Financial Measures |

||||||||

Reconciliation of Net Income (Loss) (GAAP) to Adjusted Earnings (Loss) (Non-GAAP) |

||||||||

|

|

Three Months Ended September 30, |

||||||

In millions, except per share data (unaudited) |

2020 |

|

2019 |

|||||

Net income (loss) (GAAP) |

$ |

69.9 |

|

|

$ |

59.9 |

|

|

Restructuring and other (income) charges, net |

5.5 |

|

|

1.7 |

|

|||

Acquisition and other-related costs |

— |

|

|

1.3 |

|

|||

Tax effect on items above |

(1.2 |

) |

|

(0.8 |

) | |||

Certain discrete tax provision (benefit) (1) |

— |

|

|

0.1 |

|

|||

Adjusted earnings (loss) (Non-GAAP) |

$ |

74.2 |

|

|

$ |

62.2 |

|

|

|

|

|

|

|||||

Diluted earnings (loss) per common share (GAAP) |

$ |

1.69 |

|

|

$ |

1.41 |

|

|

Restructuring and other (income) charges |

0.13 |

|

|

0.04 |

|

|||

Acquisition and other-related costs |

— |

|

|

0.03 |

|

|||

Tax effect on items above |

(0.03 |

) |

|

(0.02 |

) | |||

Certain discrete tax provision (benefit) |

— |

|

|

— |

|

|||

Diluted adjusted earnings (loss) per share (Non-GAAP) |

$ |

1.79 |

|

|

$ |

1.46 |

|

|

|

|

|

|

|

||||

Weighted average common shares outstanding - Diluted |

41.5 |

|

|

42.6 |

|

|||

(1) |

Represents certain discrete tax items such as excess tax benefits on stock compensation and impacts of changes associated with U.S. Tax Reform. Management believes excluding these discrete tax items assists investors, potential investors, securities analysts, and others in understanding the tax provision and the effective tax rate related to continuing operating results thereby providing useful supplemental information about operational performance. |

Ingevity Corporation |

|||||||

Non-GAAP Financial Measures |

|||||||

Reconciliation of Net Income (Loss) (GAAP) to Adjusted EBITDA (Non-GAAP) |

|||||||

|

Three Months Ended September 30, |

||||||

In millions, except percentages (unaudited) |

2020 |

|

2019 |

||||

Net income (loss) (GAAP) |

$ |

69.9 |

|

|

$ |

59.9 |

|

Provision (benefit) for income taxes |

18.2 |

|

|

17.5 |

|

||

Interest expense, net |

8.9 |

|

|

12.1 |

|

||

Depreciation and amortization |

25.1 |

|

|

21.5 |

|

||

Restructuring and other (income) charges, net |

5.5 |

|

|

1.7 |

|

||

Acquisition and other-related costs |

— |

|

|

1.3 |

|

||

Adjusted EBITDA (Non-GAAP) |

$ |

127.6 |

|

|

$ |

114.0 |

|

|

|

|

|

||||

Net sales |

$ |

331.7 |

|

|

$ |

359.9 |

|

Net income (loss) margin |

21.1 |

% |

|

16.6 |

% |

||

Adjusted EBITDA margin |

38.5 |

% |

|

31.7 |

% |

||

Ingevity Corporation |

|||||||

Non-GAAP Financial Measures |

|||||||

Calculation of Free Cash Flow (Non-GAAP) |

|||||||

|

Three Months Ended September 30, |

||||||

In millions (unaudited) |

2020 |

|

2019 |

||||

Cash Flow from Operations |

$ |

90.0 |

|

|

$ |

118.7 |

|

Less: Capital Expenditures |

16.5 |

|

|

22.1 |

|

||

Free Cash Flow |

$ |

73.5 |

|

|

$ |

96.6 |

|

View source version on businesswire.com: https://www.businesswire.com/news/home/20201020005627/en/