Temas Leading the Way with a Proven Environmentally Friendly Titanium-Iron-Vanadium Hydrometallurgical Recovery Process

Temas Resources Corp. (“Temas” or the “Company”, CSE: TMAS, OTCQB: TMASF) is pleased to present its break-through patented and licensed hydrometallurgical process developed in conjunction with its technology partners, ORF Technologies Inc. and Process Research ORTECH Inc. (“ORF”), to produce high value, market-ready titanium dioxide (TiO2) mineral products from hardrock and mineral sands sources for pigment manufacturing.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220203005198/en/

(Graphic: Business Wire)

Key advantages of the breakthrough hydrometallurgical process are as follows:

- High marks for Sustainability: Significantly more environmentally friendly than current processing methods – lower energy use, recyclable reagents, versatile because same process recovers by-products;

- Product specifications meet or exceed industry requirements in terms of lightness, particle size and uniformity;

- Capital and operating costs are significantly lower than alternative pyrometallurgical technologies;

- Preparing to commercialize in-house and now available to potential partners.

The proprietary “ORF” process is environmentally friendly. It utilizes low-cost, recyclable reagents, has low energy requirements because the process is carried out at ambient temperatures and pressures, and it produces no toxic waste. This is a paradigm shift for the $15 billion TiO2 industry that currently uses “Chloride” and “Sulfate” processing technologies which are toxic and affect the environmental negatively.

Another advantage of the ORF process is its ability to process lower cost, more abundant ilmenite ores (often considered waste rock) as the preferred feedstock over the less abundant, high-cost rutile/anatase minerals required by other processes. Also, there is potential additional commercial value in the recovery of Vanadium, Chromium, Magnesium, Nickel, Copper and Cobalt as by-products from the ilmenite feed that are considered disposable or impurities using other processes.

President and CEO, Michael Dehn states, “Temas is ready to partner with others in the mining and chemicals industries to make mining and mineral processing compatible with the global transition to low energy consumption, small carbon footprint, and ESG-compliance by bringing hydrometallurgical processes like this to the mining industry.”

ORF Technology Overview

Process Comparisons: The ORF process can use almost any ilmenite feedstock no matter the Iron content or Chromium, Vanadium impurities, therefore the feedstock source is flexible and attractive at current pricing of about $250/t. The TiO2 feedstock needed for the alternative processes range in price to more than $2000/t.

The Chloride process requires very high temperatures (800o – 1000oC), and the Sulphate process operates at a lower 140o – 180oC range. The ORF process has efficacy at a moderate 70oC at atmospheric pressure. The ORF and Chloride processes produce similarly high value TiO2 commercial products (~$4,000/t), while the Sulfate final product is somewhat lower value ($3,000/t).

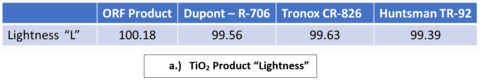

Product Specifications: All three processes produce a commercial product that is a high purity TiO2 powder (rutile or anatase). Key factors are: a.) high “Lightness” (>99), b.) high crystallinity, and c.) consistent, sub-micron particle size. Each of the key desired characteristics is illustrated in the figures below. The Temas sustainable ORF process achieves commercial specifications in its products at lower cost with less environmental impact.

Environmental Comparisons: The ORF process is more environmentally friendly than the other commercial processes. It operates at lower temperatures and atmospheric pressures, and therefore the energy requirements are lower. In addition, the reagents required by ORF are recovered, re-generated and recycled for indefinite re-use.

In operations, the Chloride process requires the management of toxic chlorine gas and high temperature acids. Similarly, the Sulfate process requires handling of sulfuric acid at high temperatures. The ORF process uses a mix of chloride-based compounds at low temperatures, thus a safer work environment. The Chloride and Sulfate processes produce an iron-rich chloride or sulfate waste sludge and remnant acids that require special disposal sites. The ORF process produces a high-quality iron oxide product meeting specifications allowing it to be sold into the steel making process. In addition, any Chromium or Vanadium, if present in the feedstock, may be recovered as oxide precipitates and processed further at low cost into commercial products.

Cost Comparisons: Because of the overall simplicity of the hydrometallurgical process flowsheet, the capital cost to construct a ORF facility is significantly lower than the Chloride and Sulfate process facility requirements. Also, operating at low temperatures and pressures minimizes risk during operations, removing the cost to construct specialty handling or safety facilities at a ORF plant. The estimated capital cost to build an ORF plant is estimated to be significantly lower than the cost to build a Chloride process facility or a Sulfate process plant of similar capacity.

On the operating cost side, the ORF process has much lower energy requirements than the alternatives, resulting in cost savings as well as a smaller overall environmental impact. Because the reagents can be recovered, re-generated and used again, these component costs are also minimized in the ORF process and waste disposal costs are minimized. Tying these low-cost operating inputs with the ability to work with low-cost process feed materials, the all-in cost to produce a quality TiO2 product ready for market using ORF is measurably lower.

Commercialization: Temas plans to utilize the ORF hydrometallurgical recovery technology as it carries out the metallurgical test work for if its Lac La Blanche TiO2 project and expects to complete testing with the technology on its Lac Brule TiO2 project as well. Both projects are in Quebec. These deposits and others in the region are igneous layered mafic intrusion styles of mineral deposits that typically have layers that concentrate Titanium, Iron, Vanadium, Chromium and occasionally Phosphorous. The mineralogy from these properties is very amenable to the ORF process. With the simple process flowsheet (shown below) during which ore is milled, then leached in vessels designed for the widely-used solvent extraction process, the commercial products are recovered as high purity oxides or metals, with minimal waste. On completion, the leach reagents are captured, regenerated and recycled to be used in a continuous or circular process at the operation.

Intellectual Property: The ORF Hydrometallurgical leach and solvent extraction processes are patented and licensed. This technology may be applied to many different ore types. Temas is making this technology available to current producers and marketing to future clients. As the mining industry everywhere moves toward more Earth-friendly processes to deliver industrial and commercial products, Temas Resources is at the forefront of developing and implementing technologies that are sustainable, low-cost and environmentally friendly.

Robert Schafer, Executive Chairman of Temas Resources, reinforces the direction that Temas is headed by stating, “We have multiple hydrometallurgical technologies available that enable the sustainable recovery of a spectrum of minerals and metals in commercial applications, all addressing the climate-change issues facing today’s World.”

Temas Resources’ vision is to establish sustainable supply chains of critical minerals by commercializing its patented, transformative metallurgical – mineral processing technologies which have smaller environmental impacts/footprint due to lower power requirements and the recycling and reuse of chemical reagents. The process technologies will improve the recovery of metals from many types of ore deposits, particularly those that are considered metallurgically-challenged, with added advantages of lower capital and operating costs. The metallurgical technologies may be applied to its own projects or may be commercialized by licensing the technology to mining companies for application at their own operations.

Temas also announces that Konstantin Lichtenwald has stepped down from the Board of Directors. The board wishes to thank Konstantin for his valuable contributions to the success of the Company.

The Company also announces that, subject to regulatory approval, it has granted incentive stock options to certain directors, officers and consultants of the Company to acquire an aggregate of 650,000 common shares in the capital of the Company at an exercise price of $0.14 (the “Options”) in accordance with its 10% rolling Incentive Stock Option Plan. All Options are fully vested as at the date of grant and exercisable for a five-year term expiring February 2, 2027.

The Company is aware that an unrelated third-party has been promoting the Company. The Company has not paid for nor approved this third-party marketing. The promotion appears to have started shortly after a large spike in trading volume of the Company in mid-January.

For the promotion the Company has seen, it appears that the material is accurate. No insiders have been involved in any of this stock promotion in any way, nor have they sold or purchased any stock immediately prior to, during or after the promotion was initially identified.

Currently Temas is working with The Howard Group, North Equities and SRAX for shareholder communication, public relations, or IR services.

Qualified Person

Robert W. Schafer, P.Geo, is the Qualified Person as defined by NI 43-101 who has reviewed and approved the technical information contained within this press release.

On behalf of the Board of Directors of Temas Resources Corp.,

“Kyler Hardy”

Director

Forward-Looking Statements

This news release includes certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward-looking statements or information.

Forward-looking statements and forward-looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Temas, future growth potential for Temas and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of iron, titanium, vanadium and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Temas’ ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220203005198/en/