Top 5 Vendors in the Unmanned Combat Aerial Vehicle Market from 2017 to 2021: Technavio

Technavio has announced the top five leading vendors in their recent global unmanned combat aerial vehicle (UCAV) market report. This research report also lists four other prominent vendors that are expected to impact the market during the forecast period.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170505005619/en/

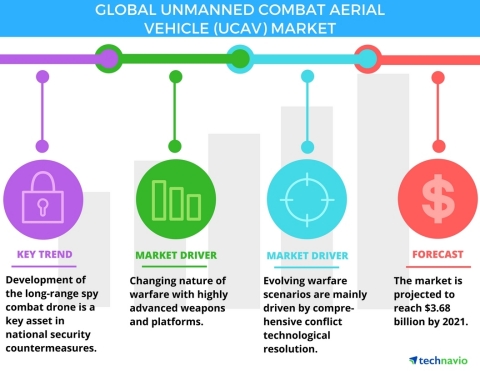

Technavio has published a new report on the global UCAV market from 2017-2021. (Graphic: Business Wire)

UCAVs are in the early stage of development, and very limited countries possess sufficient capabilities to design and develop attack drone platforms. The use of attack UAVs is increasingly gaining momentum among the North Atlantic Treaty Organization (NATO) allied countries, like the US, Israel, South Korea, and Australia.

Competitive vendor landscape

The global UCAV market is highly competitive with many prominent players competing to augment their market share. However, the entry of new vendors is expected to be restricted during the forecast period due to the stringent safety and regulatory norms along with the need for superior investments.

“Due to the rapid adoption of UCAVs for airstrike capabilities, they need to be developed and supplied cost effectively and embed effective payloads that can enhance their operation capabilities,” says Moutushi Saha, a lead defense research analyst from Technavio.

Companies with superior technical and financial resources can bring substantial change in the existing payloads and subsystems, which will help them realize the development costs in shorter development cycle time. Meanwhile, small companies can establish collaborations to compete with the existing prominent vendors.

Technavio’s insights help you make informed business decisions: Buy this report now

Technavio reports answer key questions relating to market size and growth, drivers and trends, top vendors, challenges, and more. Their analysts continuously monitor and evaluate the market landscape to help businesses assess their competitive position.

Top five UCAV market vendors

BAE Systems

BAE Systems designed and developed, Taranis, as a part of the British Demonstrator Program for UCAVs. In 2014, parts of Taranis were combined under the contract of Anglo-French development with the Dassault nEUROn (a joint European UCAV project). Currently, BAE Systems is working on the development of autonomous drone targeting.

Boeing

Boeing participated in the development of the Joint Unmanned Combat Air System (J-UCAS) X-45 drone, which was the first highly autonomous, unmanned system. The UCAV was designed specifically for combat operations in various network-centric scenarios. Under this program, the company designed and developed several combat drones such as X-45A, X-245B, and X-45C.

General Atomics Aeronautical Systems (GA-ASI)

General Atomics Aeronautical Systems (GA-ASI) designs and develops UCAVs such as Predator B (which was renamed as MQ-9 Reaper), Gray Eagle, and Predator-C Avenger. In 2016, the US Army awarded a contract to General Atomics to provide four MQ-1C Gray Eagle reconnaissance and attack drones. By 2018, the modified MQ-9 Reaper is expected to enter into service with the RAF, UK.

Israel Aerospace Industries (IAI)

Israel Aerospace Industries (IAI) combined various capabilities and lethal missiles for the development of Harop UCAV, which is designed to search, find, identify, attack, and destroy targets as well as execute battle damage assessment. The UCAV is currently operated by India, Israel, and Azerbaijan. In 2016, Harop was deployed for the first time by Azerbaijan in the Nagorno-Karabakh conflict.

Northrop Grumman

Northrop Grumman develops both surveillance and attack-enable UAVs (UCAVs) for the US and NATO allied countries globally. Northrop Grumman designed and developed the X-47B, a demonstration UCAV, as a part of DARPA's J-UCAS program. The company also manufacturers X-47A Pegasus, a stealth technology demonstrator UCAV.

Browse Related Reports:

- Global Naval ISR Market 2017-2021

- Global Military Camouflage Uniform Market 2017-2021

- Global Commercial Aviation and Military Headset Market 2017-2021

Become a Technavio Insights member and access all three of these reports for a fraction of their original cost. As a Technavio Insights member, you will have immediate access to new reports as they’re published in addition to all 6,000+ existing reports covering segments like aerospace, general aviation, and space. This subscription nets you thousands in savings, while staying connected to Technavio’s constant transforming research library, helping you make informed business decisions more efficiently.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170505005619/en/