Top 5 Vendors in the Global Synthetic Aperture Radar Market from 2017-2021: Technavio

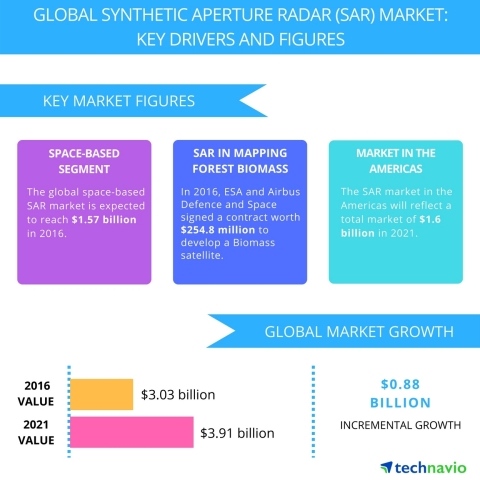

Technavio has announced the top five leading vendors in their recent global synthetic aperture radar (SAR) market report until 2021. This research report also lists four other prominent vendors that are expected to impact the market during the forecast period.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170615006367/en/

Technavio has published a new report on the global synthetic aperture radar (SAR) market from 2017-2021. (Graphic: Business Wire)

The global SAR market has seen a stable growth due to increased defense spending, especially in the Americas and the Middle East, and the rapidly growing economies like China and India. Also, the growing use of such systems by civil agencies for law enforcement and natural disaster operations has been a major reason for the market’s growth.

Competitive vendor landscape

The global SAR market is fragmented with many prominent players competing to enhance their respective market shares. However, in the space-based platform segment, there are only a few major vendors who dominate the market. Thus, a strong and sturdy competition resides among the vendors for securing key major military contracts. Operators are rapidly shifting toward an integrated communication and information sharing architecture. Companies with greater technical capabilities and financial resources are anticipated to develop and offer products and services that can make their competitors' products non-competitive and obsolete, even before they are launched.

Moutushi Saha, an industry expert at Technavio for research on defense, says, “The growth of vendors depends on factors such as market conditions, government support, and industry development. Therefore, vendors must enhance their geographical presence while reviving domestic demand to achieve sustained growth. Vendors can boost their profitability by practicing efficient production techniques that minimize product costs and mitigate associated risks.”

This report is available at a USD 1,000 discount for a limited time only: View market snapshot before purchasing

Buy 1 Technavio report and get the second for 50% off. Buy 2 Technavio reports and get the third for free.

Top five synthetic aperture radar (SAR) market vendors

Airbus Defence and Space

Airbus Defence and Space designs and develops military aircraft and a broad array of satellites that are used by defense and other government agencies across the globe. The company operates as a division of the Airbus Group.

The company developed various remote sensing satellites that are being used for Earth observation applications, which are commonly used by various European countries. Apart from that, the company has also supplied remote sensing satellites to the governments of the UAE, Kazakhstan, Japan, and South Korea.

Israel Aerospace Industries (IAI)

IAI engages in the manufacture and marketing of military and commercial aerospace and defense systems across the world. The company, primarily through its subsidiary, ELTA Systems, provides intelligence, surveillance, target acquisition, and reconnaissance (ISTAR) systems, self-protection and self-defense systems, early warning and control systems, and fire control systems. ELTA Systems also provides upgrades to airborne radar systems, as well as SAR targeting pods for military aircraft.

Lockheed Martin

Lockheed Martin engages in the production and supply of advanced technology systems and solutions to global defense and aerospace industries.

The company, primarily through its space systems business division, provides space-related technologies, systems, and equipment, as well as offers missiles technologies. The company offers newer-generation SAR technologies, like foliage penetration, ground moving target indication systems, and dual band (UHF/VHF) sensors for both civilian and military customers across the globe.

Northrop Grumman

Northrop Grumman supplies systems, products, and solutions focusing on aerospace, electronics, information systems, and technical services to the government and commercial customers across the globe.

Northrop Grumman designs and develops a wide range of radar systems used in IEDs, tactical reconnaissance vehicles, and other platforms. The company developed a small, lightweight radar, AN/ZPY-1 STARLite, for performing supportive tactical operations.

Thales

Thales provides solutions primarily to the aerospace and defense industries globally. The company is involved in the production of aerospace products, solutions, and commercialization.

Thales is supported by a strong operational network of subsidiaries located in France, New Zealand, the UK, and Australia and in regions, such as Asia, North America, Saudi Arabia, Africa, Latin America, and the Middle East. Some of its subsidiaries are Thales Optronique, Thales Air Defense, Thales Avionics, Thales Training and Simulation, and Thales Underwater Systems.

Browse Related Reports:

- Global Military Aircraft Battery Market 2017-2021

- Global Smart Weapons Market 2017-2021

- Global Military Fire Control Systems Market 2017-2021

Become a Technavio Insights member and access all three of these reports for a fraction of their original cost. As a Technavio Insights member, you will have immediate access to new reports as they’re published in addition to all 6,000+ existing reports covering segments like aerospace components, aerospace, and defense technology. This subscription nets you thousands in savings, while staying connected to Technavio’s constant transforming research library, helping you make informed business decisions more efficiently.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading-edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170615006367/en/