Automotive Brake Friction Materials Market - Drivers and Forecasts by Technavio

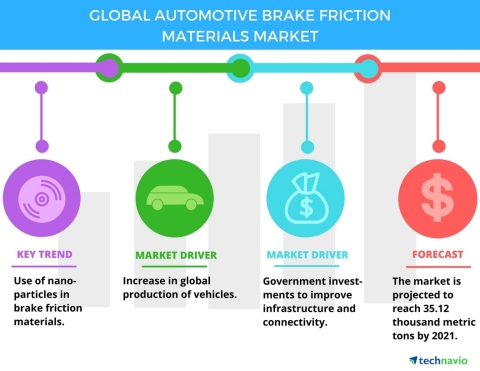

Technavio analysts forecast the global automotive brake friction materials market to grow at a CAGR of approximately 5% during the forecast period, according to their latest report.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170831005061/en/

Technavio has published a new report on the global automotive brake friction materials market from 2017-2021. (Graphic: Business Wire)

The research study covers the present scenario and growth prospects of the global automotive brake friction materials market for 2017-2021. Technavio presents a detailed picture of the market by way of study, synthesis, and summation of data from multiple sources.

APAC will be the largest user of automotive brake friction materials, and the market will grow at a faster rate than other regional markets. China, Japan, and India will be the largest users of cars and commercial vehicles in this region and hence will be the major revenue contributors to the automotive brake friction materials market in the region. China is the largest seller of passenger cars and commercial vehicles in the world.

This report is available at a USD 1,000 discount for a limited time only: View market snapshot before purchasing

Buy 1 Technavio report and get the second for 50% off. Buy 2 Technavio reports and get the third for free.

Technavio analysts highlight the following three factors that are contributing to the growth of the global automotive brake friction materials market:

- Increase in global production of vehicles

- Increasing investments by governments to improve infrastructure and connectivity

- Adherence to stringent laws formulated by governments

Looking for more information on this market? Request a free sample report

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Increase in global production of vehicles

The global production of commercial and passenger vehicles has increased. China is the leading manufacturer of vehicles, followed by the Americas and Europe. The increase in purchasing power drives the demand for passenger cars. The millennials, also known as generation Y, contribute significantly to the global passenger cars market. Familiarity with brands and inclination toward a luxurious lifestyle are the key factors that increase spending.

Kshama Upadhyay, a lead metals and minerals research analyst at Technavio, says, “The demand for commercial buses is increasing due to infrastructural developments across the globe. Governments invest in building roads and improving connectivity, which is crucial for economic development. A large number of carriers ply with goods and materials, and the public is offered improved public utility services.”

Increasing investments by governments to improve infrastructure and connectivity

Infrastructure and connectivity have a huge impact on the development of a country. Governments across the world invest in developing infrastructure, building roads, and refurbishing old roads. The governments simplify trade laws to encourage international trade. Companies focus on reducing the cost of production by entering markets that have cheap labor.

“The increase in trade will drive the demand for new vehicles to transport goods. In India, the Make in India initiative by the government focuses on improving the infrastructure for businesses. Connectivity will be improved by building roads, ports, and railways,” adds Kshama.

Adherence to stringent laws formulated by governments

Brakes are one of the major components in a car. High-quality brakes ensure the safety of passengers. Governments formulate stringent laws to promote safe driving. OEMs of passenger and commercial vehicles are under immense pressure to improve the quality of the brake friction materials. The use of asbestos is completely banned due to its carcinogenic properties. Earlier, the manufacturers used metals to improve the quality of the brake friction materials.

Many environmental bodies found out that metals, such as copper, can lead to environmental pollution. Thus, the governments have banned the use of copper and metals in brake friction pads and linings. Instead of metals, the manufacturers use ceramic substances. Washington and California have formulated regulations to reduce the use of copper by 2025.

Top vendors:

- Akebono Brake

- Robert Bosch

- Carlisle

- ITT

- Nisshinbo Holdings

Browse Related Reports:

- Global Anti-microbial Packaging Materials Market 2017-2021

- Global Oxygen Free Copper Market 2017-2021

- Silica Gel Market in the GCC Region 2017-2021

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 10,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

If you are interested in more information, please contact our media team at media@technavio.com.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170831005061/en/