Privet Fund and UPG Enterprises Send Letter to Stockholders to Expose the Web of Undisclosed Conflicts and Governance Lapses at Synalloy

Privet Fund Management LLC (together with its affiliates, "Privet") and UPG Enterprises LLC (together with its affiliates, “UPG” and collectively with Privet, “we” or “us”), which collectively own approximately 24.9% of the outstanding common stock of Synalloy Corporation (NASDAQ: SYNL) (“Synalloy” or the "Company"), today sent a letter to stockholders in connection with their nomination of five highly-qualified candidates for election to the Company’s eight-member Board of Directors at Synalloy’s upcoming 2020 Annual Meeting of Stockholders scheduled to be held on June 30, 2020. Our letter highlights what appears to be an egregious, value-destructive web of conflicts and cronyism at Synalloy. We have also issued our rebuttal presentation to Synalloy’s June 3rd presentation and a supplemental presentation unpacking the Company's numerous leadership conflicts.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200609005763/en/

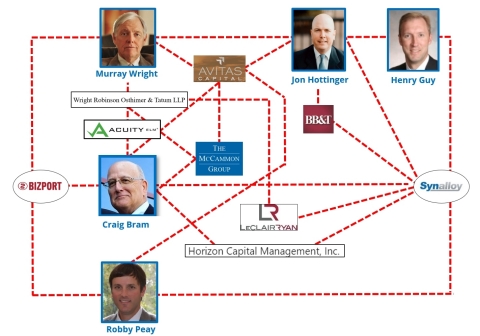

Synalloy's web of apparent conflicts and cronyism reinforce the need for significant change atop the Company (Photo: Business Wire)

As a reminder, we are urging stockholders to vote on the WHITE proxy card to elect our entire slate: Andee Harris, Chris Hutter, Aldo Mazzaferro, Ben Rosenzweig and John Schauerman.

The full text of the letter is below.

***

June 9, 2020

Dear Fellow Stockholders,

Privet Fund Management LLC (together with its affiliates, “Privet”) and UPG Enterprises LLC (together with its affiliates, “UPG”, and collectively with Privet, the “Stockholder Group” or “we” or “us”) are the largest stockholders of Synalloy Corporation (“Synalloy” or the “Company”), with aggregate ownership of approximately 24.9% of the Company’s outstanding common stock. We nominated five highly-qualified individuals for election to Synalloy’s eight-member Board of Directors (the “Board”) this spring because the Company’s current leadership lacks the operational expertise, industry experience and strategic vision needed to create enduring value for stockholders. Now we can say with confidence that we believe the Board and management also lack any comprehension of sound, transparent corporate governance.

It has come to our attention that Chairman Murray Wright and Chief Executive Officer Craig Bram have a long and troubling history of undisclosed business ventures that began decades ago and has lasted throughout their entire tenures at Synalloy. Our analysis of dozens of public filings and related materials has led us to conclude that Mr. Wright and Mr. Bram have not been honest and open with stockholders about their independent and mutual involvement at a half-dozen other companies. Along with Synalloy’s General Counsel Robby Peay, they appear to have forged a value-destructive web of conflicts and cronyism at Synalloy, while running a corporation that belongs to stockholders as if it was their own private partnership.

Given that this election contest will come down to who stockholders can trust to steward their capital and effectively lead Synalloy going forward, it is important to understand the many business activities that Mr. Wright and Mr. Bram have tried to conceal from stockholders:

- Wright, Robinson, Osthimer & Tatum – Messrs. Wright and Bram previously worked together at Mr. Wright’s eponymous law firm. They continued to use Mr. Wright’s law firm and certain employees as they pursued various businesses together over the ensuing years. Once at Synalloy, they repeatedly utilized Mr. Wright’s successor firm – LeClairRyan – to handle a meaningful amount of Synalloy’s legal work, likely totaling millions of dollars in fees. Notably, Synalloy has not disclosed that Mr. Bram previously worked at the law firm for Mr. Wright.

- Acuity (f/k/a as TrialNet) – Messrs. Wright and Bram appear to have founded the firm together, with both individuals serving as officers and directors (Mr. Bram as Chief Financial Officer). The mailing address for the firm in its early years was none other than the office of Wright, Robinson, Osthimer & Tatum. Synalloy has not disclosed that Mr. Wright has served as Acuity’s Chairman and operated alongside Mr. Bram at the firm, even though this Chairman role is shown on Mr. Wright’s public LinkedIn profile.

- Bizport – Messrs. Wright, Bram and Peay ran Bizport for most of the last decade and all served on the firm’s board of directors through the end of last year. Only after Privet and UPG nominated director candidates was it ever disclosed that Mr. Wright served as Chairman of Bizport, even though Mr. Wright has been on its board since 1987- overlapping with Mr. Bram for nearly 20 years!

- Avitas Capital – Messrs. Wright, Bram and Peay previously worked together at Avitas, which was Mr. Wright’s closely-held investment bank. Avitas also employed John McCammon, who was Mr. Wright’s former law partner, and Jon Hottinger – currently a BB&T banker – after Mr. Hottinger worked for director Henry Guy and while Mr. Hottinger simultaneously worked for Synalloy. Synalloy has not disclosed that Mr. Bram worked with Mr. Wright and Mr. Peay at Avitas at all, let alone that Mr. Bram was Managing Member of Avitas after he became Synalloy’s Chief Executive Officer. Further, in 2016, Avitas’ corporate office was listed as being at the same address as Synalloy’s corporate headquarters.

- The McCammon Group – The McCammon Group was founded by Mr. Bram and Mr. McCammon, a former colleague of Messrs. Bram and Wright from Avitas Capital and Wright, Robinson, Osthimer & Tatum. Mr. Bram is listed as a Managing Director of the McCammon Group from 1995-2011, while this business shared an address with Avitas.

- Horizon Capital Management – Mr. Bram’s public biography notes that he has run this private investment firm for years, even as his mismanagement at Synalloy continues costing stockholders tens of millions in lost value. But only by poring through Horizon Capital’s ADV filing would one discover the firm lists one of its offices as 4510 Cox Road, Suite 201 – which is Synalloy’s headquarters paid for by stockholders – and that Mr. Bram does currently “perform investment advisory functions from this office location.”1 One would also have to locate and review this filing to learn Mr. Bram has been managing nearly $9 million for his clients and collecting compensation that includes “a percentage of assets under management” and “hourly charges.” Synalloy has not adequately disclosed what corporate resources Mr. Bram is using for his private investment firm, nor has it outlined what specific guardrails exist to ensure his activity does not conflict with or undermine the Company’s interests.

- BB&T – BB&T Capital Markets, where Mr. Hottinger now works, is Synalloy’s lender and capital markets advisor, while BB&T Scott & Stringfellow advises many Synalloy stockholders. We question whether clients of BB&T Scott & Stringfellow who may have been placed in Synalloy’s stock have been informed of the Company’s relationship with BB&T and the abovementioned history of conflicts.

SYNALLOY’S WEB OF APPARENT CONFLICTS AND CRONYISM REINFORCES THE NEED FOR SIGNIFICANT CHANGE ATOP THE COMPANY

As Mr. Wright and Mr. Bram juggled their other business interests over the past decade, Synalloy underperformed the NASDAQ 100 Non-Financial Index by 293%2 and failed to capitalize on one of the greatest periods of economic expansion in history. Their derelict leadership has also resulted in chronically weak operational execution, perpetually poor inventory management practices, consistently meager margins and ballooning leverage. Disturbingly, these horrendous results have not deterred the incumbent directors from keeping Mr. Wright as Chairman and rewarding Mr. Bram with nearly $1 million per year in average compensation and a corporate jet for his flights to the Company’s plants.

Privet, UPG and our nominees have never encountered a public company that is so riddled with disclosure issues and conflicts. We believe this is the picture that Synalloy did not want stockholders to be able to piece together during this election contest.

In our view, effecting meaningful change at Synalloy is all the more essential in light of what we have discovered about Messrs. Wright, Bram and Peay. The Company is unlikely to avoid crippling financial distress and will likely never produce long-term value for stockholders as long as this compromised Board and unqualified, unreliable Chief Executive Officer remain in place. If stockholders cannot trust Mr. Wright and Mr. Bram to disclose all of their past dealings, it raises an array of serious questions:

- Has the Board not put proper guardrails around Mr. Bram’s activities at Horizon Capital because of his relationship and shared financial interests with Mr. Wright?

- Why have Mr. Wright and Mr. Bram sought to hide their overlapping involvement at Acuity (f/k/a as TrialNet), Avitas Capital, Bizport, The McCammon Group and Wright Robinson Osthimer & Tatum?

- Did the Board run a legitimate, comprehensive search process when Mr. Bram – who had no prior chemicals, metals, manufacturing, public company or large organization leadership experience – was appointed Chief Executive Officer in 2011?

- Has the Board been giving Mr. Bram a pass for well-documented mismanagement due to his long history of partnerships with Mr. Wright?

- Has the Board been rewarding Mr. Bram with nearly $1 million per year in average compensation – despite consistent underperformance – because Mr. Wright lacks objectivity?

- Has the Board been allowing Mr. Bram to benefit from a misaligned performance incentive plan because of his close relationship with Mr. Wright?

- Are the Board’s highly-personalized attacks on Chris Hutter just a collection of deliberately misleading and out-of-context accusations intended to divert attention from his impressive track record as a high-integrity industrial operator?

The fact that these questions can even be raised reinforces the need to overhaul Synalloy’s Board and management team with competent, credible and high-integrity individuals. This is exactly what Privet and UPG are offering stockholders.

DO NOT BE MISLED BY THE MISINFORMATION CAMPAIGN BEING ORCHESTRATED BY MR. WRIGHT AND MR. BRAM – IT IS TIME FOR STOCKHOLDERS TO RECLAIM THEIR COMPANY!

While we expect Synalloy’s current leadership to dispute reality and continue disparaging Privet and UPG, the truth is that only one set of nominees in this contest has communicated candidly with stockholders, released a comprehensive strategic plan to deliver up to $25 per share in near-term value and put forth an experienced interim Chief Executive Officer candidate – Mr. Hutter – who is capable of orchestrating a value-enhancing turnaround.

Synalloy has no credible excuses for its abysmal total stockholder returns under the incumbent leadership team. Nonetheless, in an absurd attempt to save face, the Board has tried to stop time on December 31, 2018, following a dramatic improvement in stainless prices due to President Trump’s tariffs. The Company is essentially asking stockholders to measure its performance as though the past 18 months never occurred. Unfortunately for beaten down stockholders, 2019 did exist and it clearly exposed Synalloy’s lack of operational prowess. Attributing stock price underperformance to supposed 2019 “macroeconomic issues” might hold water if all industry participant stocks were down sharply in 2019. However, using the Company’s own chart from its June 3rd investor presentation, stockholders can plainly see that Synalloy’s 22% stock price decline represented significant underperformance relative to the industry last year.

The Board’s efforts to mislead stockholders about Synalloy’s significant stock price depreciation in 2019 are outright insulting and represent further evidence of the Company’s dishonest tendencies. Stockholders voting in this election contest know they suffered far greater losses last year than investors exposed to the broader market and other peer companies. Irrespective of the Board’s shameless attempts to dupe stockholders by pointing to “cycle-focused analysis” and “commodity price fluctuations,” informed investors know that skilled operators and managers can – and should – create value over extended periods of time. That has not happened at Synalloy since Mr. Wright and the Board appointed Mr. Bram as Chief Executive Officer in January 2011. Unfortunately, the Company’s stock is currently trading below its price on January 24, 2011, meaning Mr. Bram has lost money for stockholders over the past nine years. Rhetoric aside, that data point tells the entire story and cannot be explained away.

PRIVET AND UPG ARE OFFERING A VIABLE ALTERNATIVE TO THE DISMAL STATUS QUO: A STRATEGIC PLAN FOR ACHIEVING UP TO $25 PER SHARE IN NEAR-TERM VALUE

We are urging stockholders to vote on the WHITE Proxy Card for all five of our nominees, who are firmly committed to restoring credibility in Synalloy’s boardroom and overseeing the implementation of a viable strategic plan that aims to achieve up to $25 per share in near-term value. It is important to underscore that the only way to ensure our plan is implemented is to elect our entire slate on the WHITE Proxy Card. Do not be fooled by Synalloy’s claims that there is no need to vote for our nominees because of the “cumulative voting effect” in this election contest. The Company’s current leadership is simply trying to confuse stockholders in an effort to retain power and remain entrenched on the Board.

As a reminder, our nominees’ strategic plan is geared towards fixing Synalloy’s glaring issues in the near-term and then positioning the Company for sustainable success as an independent public company over the long-term. Privet and UPG have no designs to take Synalloy private at any time in the future and want the Company to produce enduring value in the public markets for many years to come. Our steps to getting there include the following:

- Installing Chris Hutter as interim Chief Executive Officer

- Our plan contemplates the immediate appointment of Mr. Hutter as interim Chief Executive Officer

- As the co-architect of UPG’s industry-leading offerings and exponential growth, Mr. Hutter is exceptionally well versed in metals manufacturing and the industrials sector

-

If he assumes the role at Synalloy, Mr. Hutter will devote 100% of his time to the Company and focus all of his efforts on a rapid operational and financial turnaround

- Now that it is clear Mr. Hutter would be a far more focused and qualified Chief Executive Officer than Mr. Bram, the Board is doubling down on dishonesty and knowingly peddling misleading information to impugn his successful track record

- Prioritizing immediate strategic revenue opportunities

- We intend to unlock more than $3 million per year in additional EBITDA through strategic revenue opportunities

- Mr. Hutter and our nominees will draw on their extensive experience and deep relationships to help Synalloy drive superior cross-selling opportunities across its metals businesses

- Our plan also entails implementing a larger toolbox of sales tactics within Synalloy’s chemicals business to increase volume and utilization

- Pursuing operationally-focused gross profit enhancements

- We aim to realize approximately $20 million per year in additional EBITDA through gross profit enhancements

-

Our plan involves unlocking supply chain savings through a coordinated logistics strategy, implementing loss-reducing inventory management practices and overhauling plant-level accounting and employee incentivization policies

- Despite Synalloy’s outrageous opposition to the standard industry tactic of hedging commodities exposure, our plan accounts for the use of ongoing strategic hedges to mitigate the massive capital losses that stockholders have been forced to endure in eight of the past nine years due to the Company’s poor inventory management

- Removing non-economic and wasteful SG&A spending

- We have targeted nearly $7 million per year in additional EBITDA as a result of cost containment efforts

- We will eliminate Synalloy’s corporate-level bureaucracy by cutting down non-essential and discretionary spending and will no longer waste millions of dollars per year on unnecessary professional service fees and private jet flights

It should be abundantly clear now that the urgent case for change at Synalloy stems as much from leadership’s dishonesty as the past decade of dismal results and value destruction. Stockholders should not double down on the culture of conflicts and cronyism that Mr. Wright and Mr. Bram have fostered, especially given their deliberate efforts to conceal information very germane to this election contest. We urge stockholders to elect all five of our nominees on the WHITE Proxy Card and facilitate the corrective action that is sorely needed at Synalloy.

Thank you for your support and we invite you to visit www.StrengthenSynalloy.com to review important materials pertaining to our case for change.

Ben Rosenzweig Privet Fund Management LLC |

Chris Hutter UPG Enterprises LLC |

***

As a reminder, visit www.StrengthenSynalloy.com to view our rebuttal presentation to Synalloy’s June 3rd presentation and our supplemental presentation regarding leadership conflicts.

Stockholders can vote for Privet and UPG’s case for change on the WHITE Proxy Card.

***

About Privet Fund Management LLC

Privet Fund Management LLC is a private investment firm focused on investing in and partnering with small capitalization companies. The firm has flexible, long-term capital with the ability to effectuate investments across all levels of the capital structure. Privet was founded in 2007 and is based in Atlanta, GA.

About UPG Enterprises LLC

UPG Enterprises LLC is an operator of a diverse set of industrial companies focused on metals, manufacturing, distribution and logistics. Our success continues to be driven from within, starting with our dedicated employees who operate with a sense of urgency, commitment to customers and flexibility to do what's right on the spot without question. With 25 locations throughout North America, its operations continue to grow with the intention of building a business based on culture, respect and growth. Founded by two families with multi-generational experience in various industries, UPG prides itself on having a long-term approach to business, entrepreneurial spirit and excellent teams that represent its family of companies. To learn more, visit www.upgllc.com.

###

1 Horizon Capital Management, Inc. Form ADV dated January 20, 2020 (https://reports.adviserinfo.sec.gov/reports/ADV/115815/PDF/115815.pdf).

2 Calculated as of 12/31/2019.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200609005763/en/