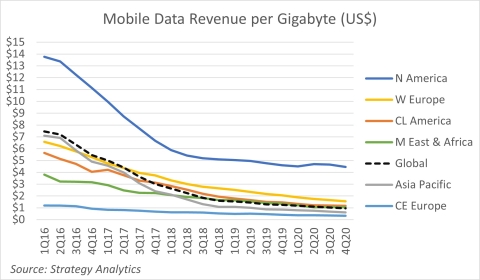

Strategy Analytics: Mobile Data Revenue Falls Below US$1 per Gigabyte as 5G Uplift Proves Elusive

Mobile operators are still struggling to create ARPU uplift from network upgrades as mobile data revenue fell below US$1 per Gigabyte for the first time in Q4 2020. According to the latest report from Strategy Analytics, “Mobile Data Revenue per Gigabyte Falls Below US$1 as 5G Ramps Up”, weak service revenue growth in the strong 5G markets of South Korea and China paint a challenging picture for consumer 5G value creation across the globe in 2021.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210413005861/en/

Figure 1. Mobile Data Revenue per Gigabyte in $USD (Source: Strategy Analytics, Inc.)

Building on data from Strategy Analytics’ Wireless Operator Performance Benchmarking database, which tracks the operators accounting for 82% of global subscriptions, global cellular data traffic increased by 35% year-on-year in Q4 2020, but total mobile service revenue increased by just 0.6%. Key findings from the report include:

- Subscriptions used on 5G networks increased from 2.1% in September 2020 to 3.0% in December 2020, with China accounting for 80% of global totals;

- China and India have a significant volume influence on global revenue per Gigabyte, averaging just US$0.55 and US$0.10 respectively in Q4;

- Speed-based tiered unlimited data plans in Finland have helped lift average revenue per user (ARPU) 17% over the last five years, compared with a 15% decline across Western Europe.

Phil Kendall, Director, Service Provider Group and report author notes “Volume-based data pricing is going to cause a headache for many operators conditioned to utility-based revenue or cost per unit thinking. With the capacity gains offered by 5G diluting value per Gigabyte, operators need ‘more for more’ pricing that offers revenue uplift through better experiences and richer content rather than through more data.”

Josie Sephton, Director, Teligen, added “With many consumers picking price plans that fit their budget first and their data usage requirements second, operators need to educate users away from high-volume low-cost plans and the idea that 150GB is meaningfully better than 100GB. We are in a data pricing merry-go-round that needs to be reset.”

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

Source: Strategy Analytics, Inc.

#SA_ServiceProviders

For more information about Strategy Analytics

Service Providers: Click here

Teligen Price Benchmarking: Click here

View source version on businesswire.com: https://www.businesswire.com/news/home/20210413005861/en/