Colgate Energy Announces Strategic Bolt-On Acquisition of New Mexico Assets

Colgate Energy Partners III, LLC (the “Company” or “Colgate”) announced today that it has entered into a definitive agreement with an undisclosed seller to purchase approximately 22,000 net acres directly offset Colgate’s existing position in Eddy and Lea Counties for $190 million, subject to customary closing adjustments. Colgate expects to finance the acquisition through a combination of cash on hand, borrowings on its revolver and/or other potential debt financing. The effective date of the transaction is September 1, 2021 and closing is expected to occur in Q1 of 2022.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211107005131/en/

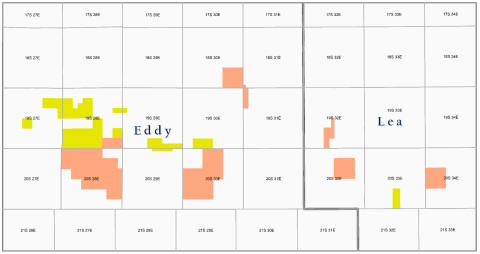

Pro Forma Acreage Map (NM Zoom-In) (Graphic: Business Wire)

Transaction Highlights

-

~22,000 net acres in Eddy and Lea Counties, the majority of which is directly offset Colgate’s legacy Parkway operating area

- The acquired acreage has an average 8/8ths net revenue interest of over 80%

- Acreage is over 95% operated with a ~78% average working interest

- Current estimated average net daily production of ~750 Boepd

-

Colgate’s 11 offset drilled and completed wells have seen extremely robust performance metrics:

- Average 30/day IP of ~3,600 boe/d(1)

- Average 6-Mon CUM oil production of 250k bbls/10K’

- Average cash-on-cash well level payout in approximately 4 months

- Adds over 200 high-quality locations that complement Colgate’s existing inventory

- Complements Colgate’s existing portfolio by adding high NRI, high IRR inventory for near term development

Pro Forma Business Highlights

- ~108,000 net acres located primarily in Reeves, Ward and Eddy Counties

- Estimated current net daily production of ~62,000 Boepd

- Currently running 5 rigs

James Walter, Co-CEO of Colgate, commented “Building on the transformative transactions completed earlier this year in Texas, this New Mexico acquisition adds to Colgate’s position as one of the premier private operators in the Permian Basin. Our focus when making acquisitions continues to be adding highly economic inventory that will drive enhanced returns and free cash flow while maintaining low leverage. Colgate’s strong balance sheet and ample liquidity allows us to execute a cash transaction of this size while continuing to target 2022 leverage of less than 1.0x.”

Will Hickey, Co-CEO of Colgate, added “The acquisition of this high-quality asset base adds to our existing inventory in the Northern Delaware Basin where we have recently drilled some of the best wells in the Company’s history. Given the depth of our current inventory, we have a very high bar for acquisitions and this one was just too good to pass up. We are excited to allocate rig activity to these properties next year.”

About Colgate

Colgate is a privately held, independent oil and natural gas company headquartered in Midland, Texas that is engaged in the acquisition, exploration and development of oil and natural gas assets in the Delaware Basin, with operations principally focused in Reeves County, Ward County, and Eddy County. For more information regarding Colgate, please visit our Investor Relations website at www.colgateenergyir.com.

Forward-Looking Statements

This press release contains forward-looking statements based on Colgate’s current expectations that involve a number of risks and uncertainties. Generally, forward-looking statements do not relate strictly to historical or current facts and may include words such as “believes,” “will,” “expects,” “anticipates,” “intends” or similar words or phrases. No forward-looking statement can be guaranteed. Numerous risks, uncertainties and other factors may cause actual results to differ materially from those expressed in any forward-looking statement. In particular, this press releases includes certain guidance with respect to future production and leverage on a pro forma basis giving effect to this transaction. This forward-looking guidance represents our management’s estimates as of the date of this press release, based on numerous assumptions that are subject to adjustment upon further review, and we undertake no duty to update these estimates in the future. Achieving these estimates will depend on the impacts of COVID-19, the availability of capital, regulatory approvals, commodity prices, drilling and completion costs, actual drilling results, business, economic, competitive, financial and regulatory risks and other factors, many of which are beyond our control. If any of these risks and uncertainties actually occur or the assumptions underlying our guidance are incorrect, our actual operating results may be materially and adversely different from our guidance.

(1) Average 30/day IP rate normalized to 10K foot laterals.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211107005131/en/