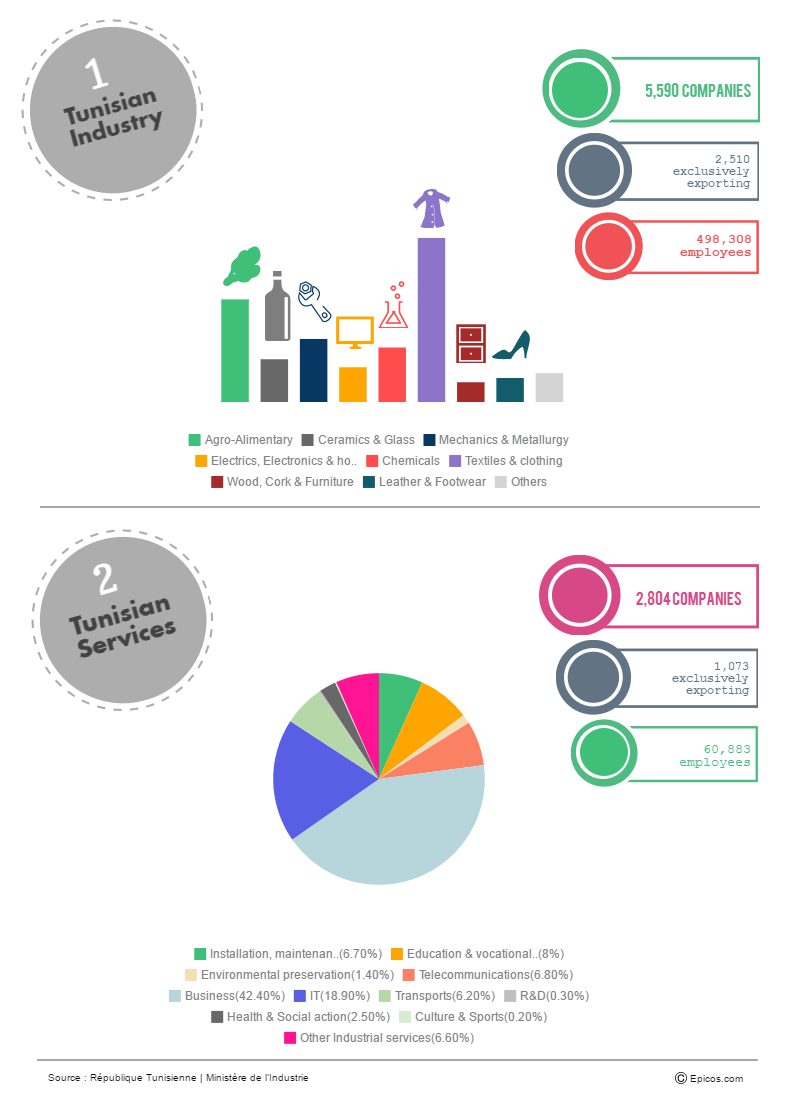

Tunisia is considered a success story in the MENA region; today, the country’s economy is characterised by diversity, with exports of goods -textiles & apparel, food, petroleum products, chemicals and phosphates-, foreign investment as well as tourism, standing as pillars of the economy. More specifically, about 8,400 companies are operating at the moment in Tunisia, in various Industrial and Services sectors (See Infographic below), with about 5,750 of those being 100% Tunisian.

Source: http://www.tunisieindustrie.nat.tn

According to 2014 data, the “Services” sector contributed some 62%, “Industry” a further 29% and “Agriculture” only some 9% to the Gross Domestic Product (GDP) of the country overall.

In more detail, after a rebound of the GDP in 2012 (+3.9%) –compared to (-1.9%) in 2011-, the external environment, combined with the political and social instability, slowed down the country’s economic growth. In 2013 and 2014, GDP grew at only 2.4% and 2.3% respectively, to slow down further a year later (See chart below). It should not be underestimated though, that terrorist attacks (in March and June of 2015) and their adverse effects on tourism, in conjunction with the social turmoil, had a significant impact to the 2015 GDP growth rate drop, to 0.8%. Despite the historically high olive oil production that boosted the agricultural sector in the same year, the effects of the low European demand, as well as the production decline in the mining, oil and gas, and commercial services sectors, could not be counterbalanced; the deficit remained above 3% of the GDP (as was the case with practically all oil-importing countries).

Predictions for 2016, foresee that growth will stabilise, as a result of the increased phosphate production and investments, as well as trade spill-overs from the Syrian war.

However despite the progress Tunisia has exhibited in recent years, including the robust growth, the openness to foreign trade and investment, and also the sustainment of its macroeconomic stability, today the country presents a weak economic activity; this can be attributed to the relatively low external demand –a repercussion of the economic developments in the EU-, the effects of the macroeconomic policies to the local demand, as well as other numerous exogenous factors – such as the conflict in Libya, as well as domestic terrorist attacks, which negatively affected the tourism industry.

During the period 2011-2015, the deficit in consumer goods broadened, mainly due to the increase of related imports. In particular, imports of cars and pharmaceuticals, increased by 36.3% and 57.1% respectively, when compared to 2010.

Considering the strong trade ties with Europe, Tunisia’s exports are expected to follow the ‘restrained’ European growth, also in 2016.

In 2015, exports dropped by 2.8%, and imports by 1.7% (in constant prices 2015). In conjunction with the falling prices however, the trade balance was improved. More specifically, total exports slightly decreased to 27.6 million TND (Tunisian Dinar), while overall imports of goods decreased to 39.7 million TND, reducing the deficit, to some -12.1 million TND.

In the same year, the European Union maintained its position as the first export market for Tunisia (74.6%), while exports to Maghreb states increased (to 9.2%), mainly destined to Algeria and Morocco. Finally, exported goods to Asia decreased slightly to 3.7%.

The predominance in exports of hydrocarbons –oil and gas-, phosphates and agricultural products has been consistent, for Tunisia during the last 15 years. However, in 2015, a significant drop of 46.9% (between 2014/2015), was recorded in the energy exports -as a result of the decline of the international hydrocarbon prices, in combination with the drop of the crude oil national production. In the same year (2015), alimentary products recorded a great export growth of 78% -decreasing the deficit to 91 million TND, fully connected with the unprecedented increase of olive-oil production and export -equal to about 1.9 Billion TND (€0.774 billion).

Therefore, in 2015, the main commodities Tunisia exported, were Food & Agriculture products (39%), Energy products (22.6%) and Phosphates mining & Derivative products (12.7%).

In 2015, Tunisia increased its total share of sales to the European Union, reaching the 55.8% of the overall Tunisian exports; the main contributors were France and Italy. In contrast, Maghreb states have decreased their share in the Tunisian market, most vividly reflected in a 41% decrease of associated exports to Algeria. It cannot be overlooked though, that Turkey and Russia remain the main suppliers of Tunisia, as far as raw materials, mining and some basic food products.

In 2015, the main commodities Tunisia imported were IME -i.e. Mechanical and Electronic Systems (39.8%), other manufacturing goods (20.1%) and Energy products (19.3%).

Notably, a record high of imports of grain products (of 24.6%) was registered in 2015, as a result of the decline in the grain harvest, during the 2014-2015 season. Finally, due to a drop in associated investments, imports of capital goods also declined.

In terms of services, Tunisia records a surplus for a number of years, as a consequence of increased exports compared to country’s imports.

Concretely, in 2014, the main services exported by Tunisia, were related to Travel & Tourism (47.56%) and Transportation (23.31%).

Regarding the services’ imports, Tunisia mostly imported Transportation services (47%) and Travel & Tourism services (19.35%).

Since the spark of the Arab spring (in 2011), Tunisia has pursued comprehensive national employment strategies, to cover, not only the youth labour market, but also to address various other employment challenges.

As expected, in line with the sectors contributing to the growth of the country’s GDP, as discussed in previous, the majority of the nation’s labour force was respectively employed in the sectors of Services (49.6%), Industry (34.2%) and Agriculture (16.2%).

Today, unemployment remains high, having reached in 2015, the 15.2% mark, with 2 out of 5 young Tunisians being unemployed, while further social issues arise from gender (39% of women aged 15-29, are not part of the country’s labour market) and regional inequalities. It is indicative that the young population’s unemployment reached 37.6%, a year earlier (in 2014).

To improve employability, the National Authority for the Evaluation, Quality Assurance and Accreditation of higher education has been created. Moreover, Tunisia recently received a $2.9 billion loan from the IMF, to support the promotion of economic inclusivity, through job creation and the protection of vulnerable households.

Thus, considering that everyday Tunisia is losing out on the considerable benefits that would arise from a well-educated and skilled labour workforce, this “social tragedy” (as youth unemployment is described in OECD reports), should be confronted at the earliest possible, in the most effective manner; towards this direction, an effective matching of skills to market demand, as well as initiatives for creating more attractive hiring conditions for potential employers, are essential.

Despite the increase in 2012 FDI inflow, under the continuous political uncertainty and the potential effects that could bring, FDI inflows in 2013 were reduced to US $1.05 billion, only to stick to the same levels, up to the present day (2015).

According to the World Bank’s “Doing Business” report, Tunisia ranks today (2016) at the 74th position of ‘attractiveness’ as a business destination, standing just above Morocco, and much higher than the MENA regional average. This was not a matter of chance though; in order to reduce the effects of deterioration in port infrastructure and inadequate terminal space, as well as to facilitate trade across borders, Tunisia upgraded its electronic logistics system and reduced border compliance time, for imports and exports, through investments in logistics infrastructure and in the port of Rades. In addition, the new coalition government (that took office in 2015), aiming to further attract private investments and at the same time align the legislative framework with the economic priorities of the country, has reduced the corporate profits tax rate (from 30% to 25%, in 2014/2015), pushed towards a longstanding legislation, adoption of laws on competition, central bank statutes and bankruptcy procedures. It is indicative that in recent years, privatisation with foreign participation, has occurred in many sectors including telecommunications, banking and manufacturing.

Nevertheless, significant further investments in infrastructure are needed, in order to improve connectivity, especially in terms of linking the coastal areas with the interior of the country.

Furthermore, according to the OECD, establishment of free price-control agricultural zones, would boost production and thus help the elimination of imbalances between rural and urban areas of the country.

In addition, labour policies targeted to vocational and educational training should be enhanced, to fill the gap in the demand for highly qualified young people, with an appropriate skills set. Regarding the latter, additional options for the working and unemployed population, may result under the recent private sector boost.

Considering that almost 50% of country’s budget is used for procurement, the adoption of a new regulatory framework, would help towards the creation of more predictable and transparent business conditions. Given that improvement of the business environment is vital in order to attract investments, as suggested by the National Bank of Tunisia, a new code of investments and reforms, would also aid in this direction.

Moreover, the adoption of a revised agricultural policy, that encourages the cultivation of products, whose imports percentage is high (e.g. cereals), and focuses as well on the management of certain products (e.g. milk, tomatoes) for maintaining self-sufficiency, is essential.

Last but not least, restricting the smuggling of products, especially those rerouted to neighbouring countries, is crucial for business reinforcement.