Australia is one of the biggest agricultural, mining and energy producers in the world. In 2016, Australia entered its 26th year of uninterrupted annual economic growth, and its economy is projected to continue growing well into the 2020s, with an average annual real GDP growth rate of 2.9% over the period 2016-2020.

Driven by increased commodities demand from China and other countries in Asia, the mining boom began in Australia in around 2003. The world price of Australia’s mining exports more than tripled over the decade 2004-2014, while investment spending by the mining sector increased from 2% of the GDP, to 8%. The price of resources such as iron ore, LNG, metallurgical and thermal coal soared from $20-50/tn to more than $150/tn and remained high for a long period of time. The mining boom came at a time when the rest of the world was experiencing the global financial crisis and helped Australia escape its effects - one of the very few countries to do so. According to a study conducted by the Reserve Bank of Australia, by 2013, it is estimated that the mining boom raised real per capita household disposable income by 13%, real wages by 6% and lowered the unemployment rate by about 1.25%.

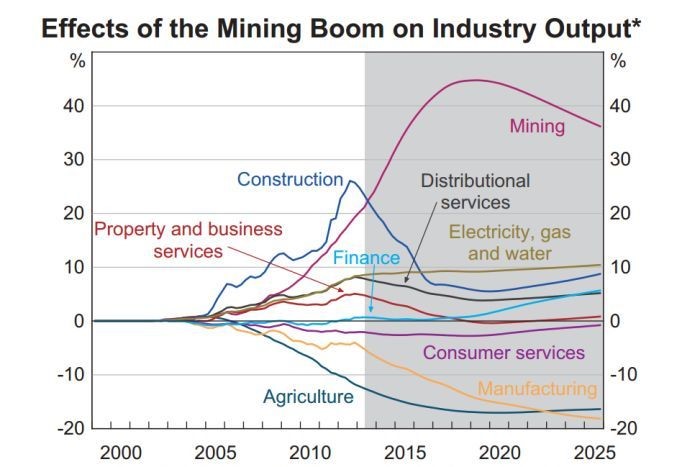

Source: The Effect of the Mining Boom on the Australian Economy - Percentage deviation of baseline estimates from the no-mining-boom counterfactual

Source: The Effect of the Mining Boom on the Australian Economy - Percentage deviation of baseline estimates from the no-mining-boom counterfactual

Such a sector-specific boom however can have disparate effects on other export industries (such as agriculture, manufacturing), due to the large appreciation of the national currency. Australia’s agricultural industry weathered the times, due to elevated demand for agricultural commodities globally, and especially by China.

Lasting more than a decade and a half, the mining investment boom is gradually coming to an end and hence the national economy is in a state of transition. In 2015, the domestic industry saw growth in output across all sectors (such as Services, Mining and Agriculture, Forestry & Fishing), with the exception of Manufacturing and Construction. Faced with competitiveness challenges, Australia is looking to diversify the drivers of growth. An effective and competitive enabling services sector, appropriate regulation and increased R&D, are among the prime focus areas in this effort. Unemployment rate remained stable at 5.6% for 2016, while Australia continues to be a popular migration destination, especially for skilled migrants. Indicatively, the unemployment rate for recent migrants and temporary residents combined, was 7% in 2011.

The services sector is the largest part of the Australian economy, accounting for around t70% of gross domestic product and 3 out of 4 jobs. Another important economical facet of Australia is that the country is a major regional financial centre and a vital part of the global financial system. The Australian Stock Exchange and the Sydney Futures Exchange merged in 2006 and formed the world’s 8th largest listed exchange, the Australian Securities Exchange (ASX). In February 2017, the ASX had 2,222 listed companies with a domestic market capitalization of some 1.5 trillion AUD (Australian Dollars). These numbers have remained quite stable over the last decade (2006-2016). Furthermore, ASX has strong links with the major stock markets of Asia and operates in a rather privileged time zone which spans the closure of the markets in the United States and the opening of markets in Europe.

Since the 1970s, Australia has undergone several and continuous structural and policy reforms. As a result, nowadays (2017), the country has a stable institutional and regulatory structure. Some of these reforms included the progressive cut off of several former protectionist tariffs, the introduction of domestic competition laws, the deregulation of the national financial market, the decentralization of the Australian labour market and the stabilization of the national macroeconomic policies. Additionally, Australia lowered barriers to trade and investment, an aspect that created extensive competition across the entire spectrum of the national economy, including key areas such as the financial, air transport and telecommunications sectors.As a result, Australia is consider to be one of the easiest places in the world to do business. Overall, Australia ranks 15th worldwide for ease of doing business, according to the World Banks’ “Doing Business 2017” report. More on that, the country scores well in several international indicators measuring the ‘openness’ of a country’s economic and business environment. Specifically, Australia ranked 5th out of 180 countries in the 2017 Heritage Foundation’s “Index of Economic Freedom” and 19th out of 128 in the 2016 “Global Innovation Index”.

The Australian economy handled well the international economic and financial downturns of the 2008 crisis, exhibiting steady GDP growth (between 2% and 4% from 2007 until 2015), while maintaining low external debt to GDP ratios. Unemployment has remained stable between 5-6% of the labour force for the last 5 years (2011-2016). The Australian Government has repeatedly shown a commitment to maintain strong economic growth and to further boost the national economy.

Trade plays an important role in the economic status quo of Australia. It is indicative that Australia’s two-way trade in goods and services was valued at 515.4 Billion AUD in 2015-16 . Commodities dominate merchandise exports with iron ores & concentrates, coal, gold and natural gas being Australia’s top exports in terms of value. As a consequence, highly industrialised nations such as China, Japan, South Korea, the United States, and India are the country’s top export destinations. On the other hand, Australia’s top imports are vehicles, refined petroleum, telecom equipment, computers and medicaments, mainly from China, the United States, Japan, Thailand and Germany.

In order to further reinforce trade, the Australian government signed free trade agreements (FTA) with several of its most important trade partners. The Australia-US Free Trade Agreement (AUSFTA) was entered into force on January 2005, while the China-Australia Free Trade Agreement (ChAFTA) came into force in December 2015. Australia also has Free Trade Agreements with New Zealand and ASEAN, Singapore, Thailand, Chile, Korea and Japan. The countries covered by these FTAs account for 42% of Australia's total trade. The Trans-Pacific Partnership Agreement (TPP) negotiations, undertaken by Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, Peru, New Zealand, Singapore, the United States and Vietnam, successfully concluded in October 2015, but the Agreement has not yet entered into force (in early 2017). Moreover, Australia is engaged in seven FTA negotiations—two bilateral FTA negotiations with India and Indonesia, and five plurilateral FTA negotiations with the Gulf Cooperation Council, the Pacific Trade and Economic Agreement (PACER Plus), the Trade in Services Agreement (TiSA), the Environmental Goods Agreement, and the Regional Comprehensive Economic Partnership Agreement.