IHS Markit US Manufacturing PMI™

September data indicated a strong improvement in operating conditions across the U.S. manufacturing sector. The overall performance was driven by sharper rises in output and new orders, though new business from abroad continued to expand at only a marginal pace. A faster increase in new orders contributed to greater capacity pressures, with backlogs accumulating at the joint-fastest rate since September 2015.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20181001005915/en/

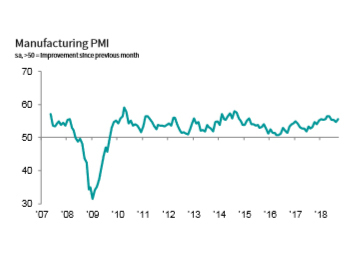

IHS Markit US Manufacturing PMI (Source: IHS Markit)

Meanwhile, input prices continued to increase sharply. Components shortages and increased demand for inputs reportedly pushed purchase costs higher. Firms were able to partly pass greater costs onto clients through a solid rise in charges.

The seasonally adjusted IHS Markit final U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) registered 55.6 in September, up from 54.7 in August. The headline figure rose to a four-month high and was well above the series trend. Although the average for the third quarter was strong overall, it signalled the softest expansion since the fourth quarter of 2017.

Production across the goods-producing sector rose at an accelerated and sharp rate in September. The upturn was the fastest since May and was attributed to a sustained rise in new business and more favourable demand conditions.

New orders received increased markedly, with the rate of expansion quickening to reach a four-month high. Panellists stated that stronger client demand and increased marketing activity drove the rise in order book volumes. New export orders, however, rose marginally as firms noted concerns surrounding the effect of tariffs on foreign demand.

Reflective of a sharp increase in overall new orders, the rate of backlog accumulation accelerated. Moreover, September data signalled the joint-quickest rise in outstanding business in three years. As a result, employment continued to expand, albeit at the softest pace for 13 months.

Growth of purchasing activity accelerated amid the faster expansion of new orders. Input buying rose at the quickest rate since April and pre-production inventories increased at the strongest pace since December 2016.

On the price front, cost burdens continued to rise markedly. The rate of input price inflation matched that seen in August, with panellists commonly attributing the increase to tariffs and greater demand for inputs. Firms were able to partly pass higher costs on to clients, with charges increasing solidly. That said, the rate of inflation dipped to a nine-month low, amid reports that some companies were reluctant to raise factory gate prices.

Manufacturers exhibited ongoing confidence towards the outlook for output, with optimists continuing to exceed pessimists. Expected growth was generally linked to new product development and forecasts of firmer demand conditions. However, the overall degree of optimism was the lowest recorded for a year.

COMMENT

Chris Williamson, Chief Business Economist at IHS Markit, said:

"US manufacturing showed resilience in the face of storms in September, with output rising at one of the fastest rates seen so far this year. New orders growth has lifted to the highest since May and is being boosted in particular by strong domestic demand, especially in consumer markets. In contrast, export orders grew only very modestly again.

“Worries about trade wars and tariffs continued to dominate, pushing business confidence in the outlook down to its lowest for a year.

“Tariffs, alongside higher oil prices, were meanwhile a key factor reportedly driving input costs higher. Almost two-thirds of all companies reporting higher input prices ascribed the increase to tariffs.

“Worries about the impact of tariffs on prices also led to increased incidences of stock building, exacerbating existing supply chain delays and driving prices further higher. Raw material inventories rose at one of the steepest rates seen this side of the global financial crisis. While stock building boosts current sales at suppliers it poses downside risks to growth in future months.”

Methodology

The IHS Markit US Manufacturing PMI™ is compiled by IHS Markit from responses to questionnaires sent to purchasing managers in a panel of around 800 manufacturers. The panel is stratified by detailed sector and company workforce size, based on contributions to GDP.

Survey responses are collected in the second half of each month and indicate the direction of change compared to the previous month. A diffusion index is calculated for each survey variable. The index is the sum of the percentage of ‘higher’ responses and half the percentage of ‘unchanged’ responses. The indices vary between 0 and 100, with a reading above 50 indicating an overall increase compared to the previous month, and below 50 an overall decrease. The indices are then seasonally adjusted.

The headline figure is the Purchasing Managers’ Index™ (PMI). The PMI is a weighted average of the following five indices: New Orders (30%), Output (25%), Employment (20%), Suppliers’ Delivery Times (15%) and Stocks of Purchases (10%). For the PMI calculation the Suppliers’ Delivery Times Index is inverted so that it moves in a comparable direction to the other indices.

Underlying survey data are not revised after publication, but seasonal adjustment factors may be revised from time to time as appropriate which will affect the seasonally adjusted data series.

September 2018 data were collected 12-24 September 2018.

For further information on the PMI survey methodology, please contact economics@ihsmarkit.com.

About IHS Markit

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions.

IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates. All other company and product names may be trademarks of their respective owners © 2018 IHS Markit Ltd. All rights reserved.

About PMI

Purchasing Managers’ Index™ (PMI™) surveys are now available for over 40 countries and also for key regions including the eurozone. They are the most closely watched business surveys in the world, favoured by central banks, financial markets and business decision makers for their ability to provide up- to-date, accurate and often unique monthly indicators of economic trends. To learn more go to ihsmarkit.com/products/pmi.html.

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to IHS Markit. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without IHS Markit’s prior consent. IHS Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall IHS Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers’ Index™ and PMI™ are either registered trade marks of Markit Economics Limited or licensed to Markit Economics Limited. IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates.

View source version on businesswire.com: https://www.businesswire.com/news/home/20181001005915/en/